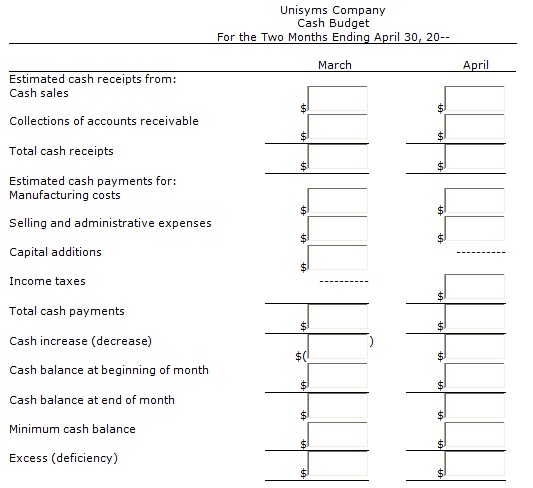

Problem:

The treasurer of Unisyms Company has accumulated the following budget information for the first two months of the coming year:

March April

Sales. $450,000 $520,000

Manufacturing costs 290,000 350,000

Selling and administrative expenses 41,400 46,400

Capital additions 250,000 ---

The company expects to sell about 35% of its merchandise for cash. Of sales on account, 80% are expected to be collected in full in the month of the sale and the remainder in the month following the sale. One-fourth of the manufacturing costs are expected to be paid in the month in which they are incurred and the other three-fourths in the following month. Depreciation, insurance, and property taxes represent $6,400 of the probable monthly selling and administrative expenses. Insurance is paid in February and a $40,000 installment on income taxes is expected to be paid in April. Of the remainder of the selling and administrative expenses, one-half are expected to be paid in the month in which they are incurred and the balance in the following month. Capital additions of $250,000 are expected to be paid in March.

Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000. Current liabilities as of March 1 are composed of accounts payable of $121,500 ($102,000 for materials purchases and $19,500 for operating expenses). Management desires to maintain a minimum cash balance of $20,000.

Prepare a monthly cash budget for March and April.