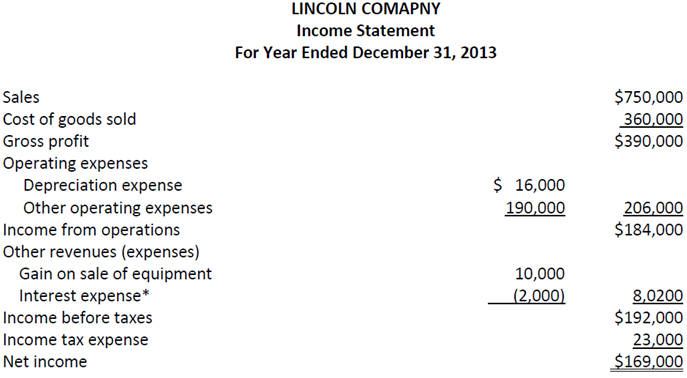

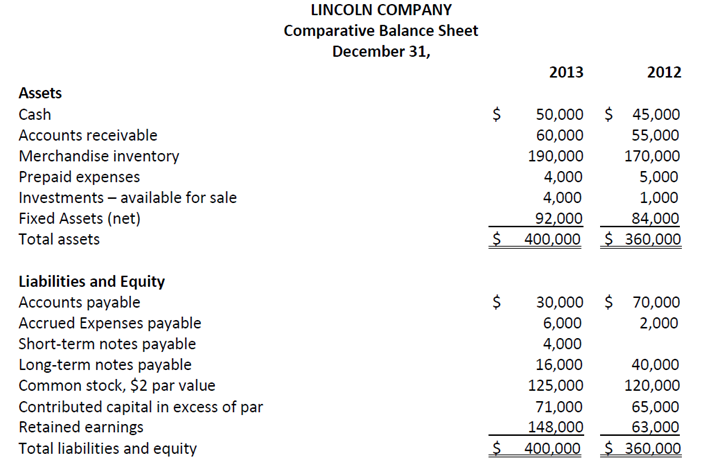

Lincoln Company, a merchandiser, recently completed its calendar-year 2013 operations.

Identified as an expense rather than a revenue by reporting the amount in parantheses.

Additional Information on Year 2013 Transactions

1. Sold equipment costing $20,000, with accumulated depreciation of $14,000, for $16,000 cash.

2. Purchased equipment costing $30,000 by making a cash down payment of $14,000 and issuing a $16,000 long-term note payable for the balance.

3. Borrowed $5,000 cash by signing a 90-day note payable.

4. Paid cash to reduce one $40,000 long-term notes payable.

5. Issued 1,000 new shares of common stock for cash at $11 per share.

6. Declared and paid cash dividends of $84,000.

7. Interest expense paid in cash, $4,000

8. Income taxes paid in cash, $22,000.

Required:

1. Prepare a complete statement of cash flows using the indirect method.

2. Disclose any noncash investing and financing activities and supplemental cash flow information in the manner discussed in the textbook and the powerpoint. If you don't know what I mean, look it up.

3. Answer the following questions based on your completed Statement of Cash Flows:

a. Looking at the investing activities only what was the single largest sources of cash during and the single largest use of cash during 2013?

b. Looking at financing activities only what was the single largest sources of cash during and the single largest use of cash during 2013?

c. What caused the biggest difference between net income on the income statement and cash flows from operating activities on the cash flow statement. The answer is found on the cash flow statement itself.