Question 1.

The following questions are required to be answered relate to the course text

Questions

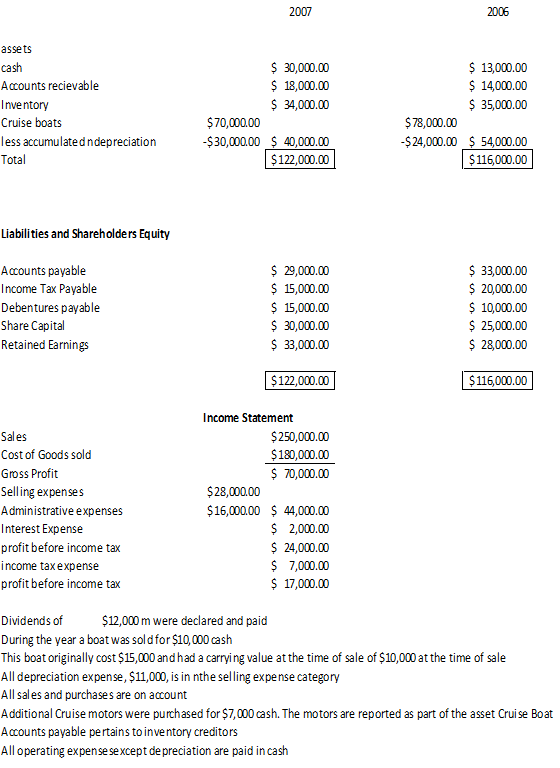

a) Statement of Cash flows direct method Chapter 18 ;

Required

i. Prepare a cash flow statement using the direct method for operating cash flows

ii. Prepare a reconciliation of the profit and cash provided by the operations

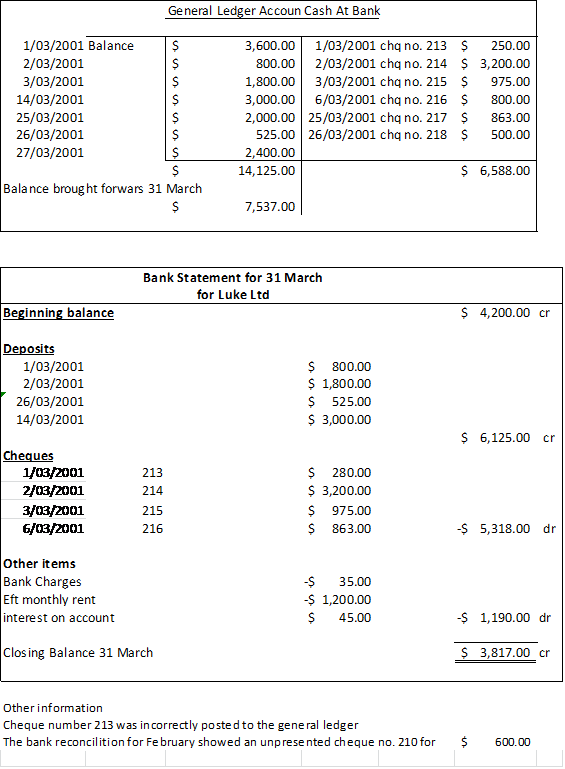

b) Bank reconciliation

Required prepare a bank reconciliation for the Month ended the 31 March 2001

c) Accounting for Shares

Demons Ltd issued a prospectus for the issue of 100,000 $5.00 shares on 1 January2012.The prospectus required payment of $3.00 per share on application and $2.00 to be paid when called.

The company received applications for 120,000 shares by the closing date of 28February 2012.100,000 shares were issued on 1 March 2012 with excess application money being refunded.

On 30 April 2012 the company called the balance of $2.00 on the shares. All call money was received by 15 May 2012.On 30 June 2012 Demons Ltd declared and paid a dividend of 5 cents per share.

Required:

Prepare the journal entries for the year ended 30 June 2012 to account for the above transactions.

d) Accounting for Liabilities

Easy Company Ltd issues a debenture at a premium for a period of 10 years the company pays interest on 31 December and 1 July. The debenture has a par value of $1,000,000.00 and is issued at premium of 105 at an interest rate of 9%

Prepare journal entries to reflect the following;

i. issue of debentures on 1-July

ii. payment of interest on 1 January

iii. accrual on 31 March

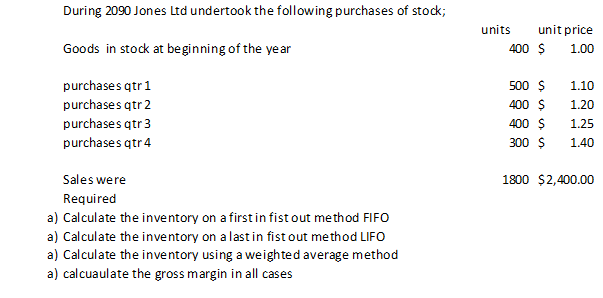

e) Accounting for Inventory

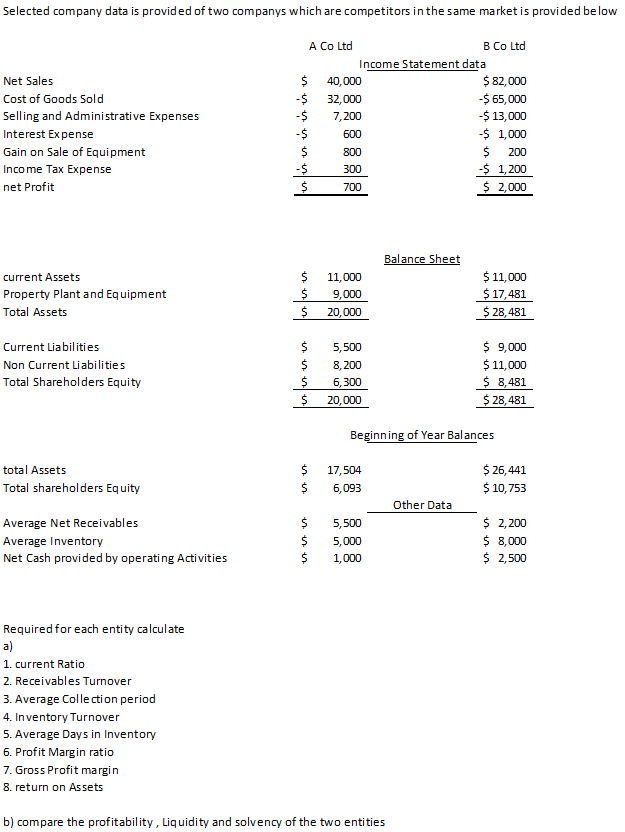

f) Analysis of Accounting Information

g) Preparation of production and cash budget 10 marks

|

Budget data

|

|

|

|

|

|

|

|

unit sales

|

|

|

|

|

|

January

|

25,000.00

|

|

|

|

|

|

February

|

30,000.00

|

|

|

|

|

|

March

|

32,000.00

|

|

|

|

|

|

|

|

|

|

|

|

|

selling price

|

|

$ 10.00

|

per unit

|

|

|

|

|

|

|

|

|

|

|

cash sales

|

|

|

20%

|

during month of sale

|

|

Collections on account

|

|

50%

|

in month of sale

|

|

Collections on account

|

|

25%

|

after month of sale

|

|

Amount uncollectable

|

|

5%

|

|

|

|

balance on accounts receivable at 1 January

|

|

|

$ 420,000.00

|

|

Of which $350,000 relates to December sales and the remainder related to November sales

|

|

5% of the total balance is uncollectable

|

|

|

|

|

prepare sales budget for the quarter

|

|

|

|

|

prepare cash collections budget for the quarter

|

|

|

|

Calculate the balance in accounts receivable at the end of March

|

|