Question 1

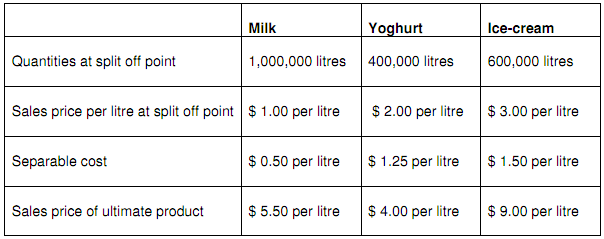

Jumbo Giant Limited manufactures three products, namely, Milk, Yoghurt and Ice-cream.

The initial joint cost of production is $600,000 for the year. This cost results in an output of 2,000,000 litres. Details relating to the 3 joint products are given below:

Required:

1. Allocate the joint cost between Milk, Yoghurt and Ice Cream using

a) The Physical Method.

b) The Relative Sales Value Method. Round percentage to 2 decimal places.

c) Net Realisable Value Method. Round percentage to 2 decimal places.

2. Jumbo Giant Limited has a request from a prospective customer to further process all its Ice Cream production into Gourmet Ice Cream which will then be bought by the customer for $12.00 per litre. This will increase the separable costs of ice cream per litre to $2.60. Would you advise the company to accept the offer? Why or why not?

Question 2

Mighty Mouse Limited estimates the following information for October 2014:

Sales (Units) 22,000

Inventory - 1st

October 2014 9,000

Inventory - 31st October 2014 7,500

The company's inventory policy requires ending inventory to be equal to 25% of the prior month's sales.

The company predicts sales to increase by 5% in November. December is a slow month and sales are estimated at 70% of November sales.

The cost price per unit is $5.00 and this expected to increase by 10% in December.

Required: Prepare a purchases budget in units and dollars for the quarter ending 30th December 2014.

Question 3

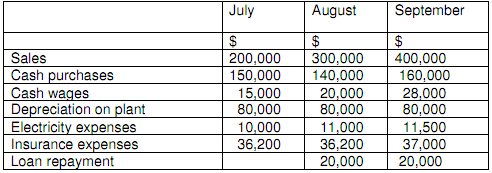

Fussy Hair Ltd has decided to prepare a cash budget for the quarter ending 30st September 2014 and provides you with the following data:

Services are provided on 30 day credit terms. As at 1 July 2014, the Cash at bank ledger account had a debit balance of $500,000.

The following estimates have been made for the next three months:

All sales are on credit.

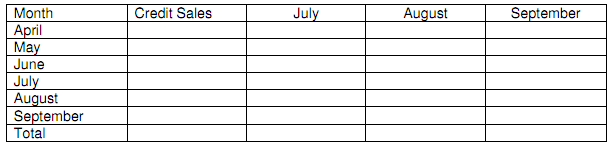

�It is expected that debtors will pay their accounts as follows:

o 50 per cent in the month following the sale.

o 20 per cent in the second month following the sale.

o 30 per cent in the third month following the sale.

�Actual sales for the previous three months were as follows:

o $300,000 in April 2014

o $290,500 in May 2014

o $320,000 in June 2014

�Electricity expenses and insurance expenses are paid the following month after they are incurred. June expenses were as follows:

o Electricity expenses $8,000

o Insurance expenses $35,000

Required:

Part A:

Using the following template, prepare a schedule of cash receipts from debtors for the period ending 30th September 2014.

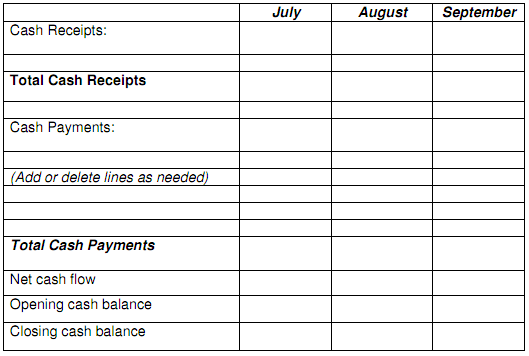

Part B:

Using the following template, prepare a Cash budget for the Quarter ending 30th September 2014.

Question 4

Terrific Tables Pty Ltd incurred the following costs to produce job number TB300, which consisted of 500 office desks.

Direct material:

1 June Requisition no. 520: 900 metres of timber @ 8.00 per metre

18 June Requisition no. 101: 600 metres of steel @ $0.20 per metre

Direct labour:

18 June Timesheet no. 72 500 hours@$14 per hour

Manufacturing overhead:

Applied on the basis of direct labour hours @$12 per hour.

Additional information:

Job TB300 was completed on 18 June.

Required:

Prepare a job cost sheet and record the information given above and also a cost summary for job TB300.

Attachment:- Assignment.rar