Question 1: Preparation of a Statement of Cash Flows Wisconsin Bottlers is a rnicrobrewery in Milwaukee. By the end of 20X I, the company's cash balance had dropped to $6,000, despite net income of $239,000 in 20X I. Its transactions affecting income or cash in 20X I were (in thousands):

1. Sales were $3,003, all on credit. Cash collections from customers were $2,899.

2. The cost of items sold was $2,096.

3. Inventory increased by $56.

4. Cash payments on trade accounts payable were $2,140.

5. Payments to employees were $305; accrued wages payable decreased by $24.

6. Other operating expenses, all paid in cash, were $105.

7. Interest expense, all paid in cash, was $26.

8. Income tax expense was $105; cash payments for income taxes were $108.

9. Depreciation was $151.

10. A warehouse was acquired for $540 cash.

11. Equipment was sold for $37 cash; original cost was $196, accumulated depreciation was $159.

12. Received S28 for issue of common stock.

13. Retired long-term debt for $25 cash.

14. Paid cash dividends of $89.

Prepare a statement of cash flows using the direct method for reporting cash flows from operating activities. Omit supporting schedules.

Question 2: Net Income and Retained Earnings

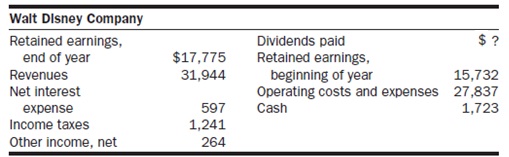

Walt Disney Company is a well-known entertainment company. The following data are from its 2005 annual report (in millions):

1. Prepare Disney's income statement for the year. The final three lines of the income statement were labeled as income before taxes, income taxes, and net income.

2. Compute the change in retained earnings, and use that to determine the amount of dividends paid.

3. Comment briefly on the relative size of the cash dividend.