Case Study: Planning for Growth and Du Pont Analysis

You should include a brief summary (must be 350 words or more) of the case background description (in your own words) of this case study given below and the answer (in your own words) to each attached question.

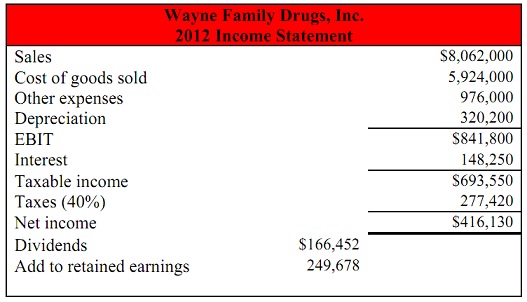

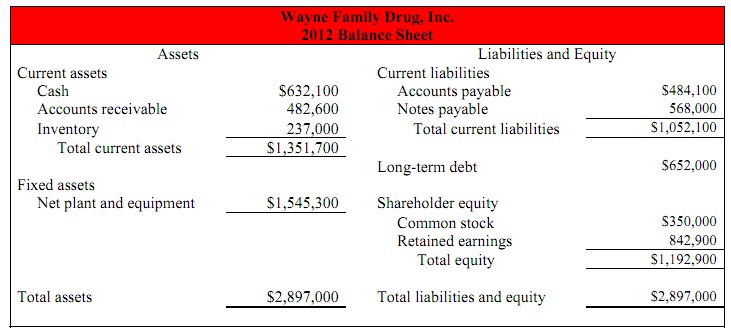

Wayne Family Drugs, Inc. was founded by Larry Davidson and his friend in 2002 in Richmond, Indiana. Both founders are chemical engineers and have no prior training in business administration, especially in financial management. Due to the lack of the related expertise, the company has never been using any financial planning for its investment needs. Therefore, Wayne Family Drugs is currently running into some financial difficulties, resulted in severe cash flow problems. In addition to losing sales, Wayne Family Drugs is also falling short of revenue and profit to pay salaries to the founders. So, there is, no doubt, an urgent need for the company to be able to prepare a sound financial plan for next year (2013) to cope with the anticipated investment requirements.

Wayne Family Drugs is looking forward to a growth rate of 20 percent in 2013 (i.e. its sales is expected to increase by 20%). The firm has decided to hire you as a financial consultant to fix all the cash flow problems for them.

1) You are expected to calculate the internal growth rate and sustainable growth rate for Wayne Family Drugs, and explain to the founders what these numbers mean.

2) Wayne Family Drugs is currently operating at full (100%) capacity. Larry Davidson, one of the founders of the company, would like you to advise them on what amount of external financing will be needed (EFN) for 2013 and whether Wayne Family Drug’s sales can rise at this particular rate of growth? Please be reminded to include the necessary assumptions, pro forma income statement and pro forma balance sheet in your answer in addition to other workings.

3) Wayne Family Drug’s fixed assets can only be acquired in multiples of $2,500,000 (i.e. adding a new product line will call for an additional investment of $2,500,000 in new equipment) once Wayne Family Drugs has reached its full operating capacity. Larry is eager to know what the new external financing needed (EFN) should be as the firm is now already operating at its full capacity. In addition, they also ask you to estimate the new level of capacity utilization of the fixed assets for Wayne Family Drugs in next year when the new production line has been implemented. Please be reminded to include the new pro forma income statement and pro forma balance sheet in your answer in addition to other workings.

4) Larry is interested in knowing as well how the firm’s ROE will change from 2012 to 2013 according to the projected growth rate (subject to the condition that the firm can only acquire the required fixed assets in multiples of $2,500,000, the owners are not going to put in more capital and the firm’s payout ratio remains at the 2012 level). You are expected to do a Du Pont analysis comparison between the two years. For the Du Pont analysis, you must include both the calculations and the explanations.