Question 1: Stella Ann Freeman is having a difficult time deciding whether or not to purchase a new car. How would understanding the concept of opportunity costs help her make a decision?

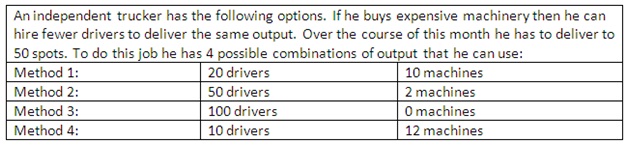

Question 2: Referring to the below table, hiring a driver costs $10. Each machine costs $100. Which technique should he use and why?

Question 3: Enron will be an instance of a dysfunctional company for many years to come. It was clearly a company riddled with fraud and excess and its conduct drove it into bankruptcy. The text argues that individual behavior was not at the core of Enron’s problems. What were the problems with this corporation from an organizational architecture view point?

Question 4: For many corporations like utility companies, a major part of the cost of production is fixed in the short run. Should such very large fixed costs be ignored when the executives are making output and pricing decisions? Describe Why?

Question 5: Select a real-life illustration of a firm which you think is part of an oligopoly market and explain the characteristics of the market structure which describe why the firm would be categorized as such.

Question 6: You are the manager for Dunkin Donuts and know the given elasticities:

η = 1.5 ηI = 1.2 η xy1 = 0.5 η xy2 = -0.5

η is the price elasticity of demand for Dunkin Donuts (DD) glazed doughnuts, ηxy1 is the cross elasticity of demand between DD glazed doughnuts and Krispy Kreme (KK) glazed doughnuts, ηxy2 is the cross elasticity of demand between DD glazed doughnuts and DD French Vanilla coffee, and ηI is the income elasticity of DD glazed doughnuts.

a) If you want to raise your sales of glazed doughnuts by 30%, in what direction and by how much do you require changing the price?

b) If you make the percentage price change that you computed in part a) will total revenue raise or drop? How do you know?

c) Krispy Kreme lowers its price of glazed doughnuts by 20%. The demand for Dunkin Donuts glazed doughnuts will modify by what percentage and in what direction?

d) Dunkin Donuts increases the price of its French Vanilla coffee by 15%. The demand for Dunkin Donuts glazed doughnuts will modify by what percentage and in what direction?

e) If average income rises by 5% by what percentage and in what direction will the demand for Dunkin Donuts glazed doughnuts modify? Are DD glazed doughnuts a normal good or an inferior good and how do you know?

Question 7: Westinghouse and General Electric are competing on the newest version of clothes washer and dryer combinations. Two pricing strategies exist: price high or price low. The profit from each of the four possible combinations of decisions is given in the given payoff matrix:

a) Which strategy offers both Westinghouse and General Electric the best financial outcome?

b) Does either firm have a dominant strategy? If yes, which firm and what strategy?

c) The Nash equilibrium is for Westinghouse to set its price at __________ and earn a gain of __________ and for General Electric to set its price at ______________ and earn a gain of _____________.

d) Why do we see that the strategy that outcomes are not the strategy which offers both players the best financial outcome?