Part A:

Question 1:

a) Show that the nominal rate of interest convertible once in every 4-year is to a nominal rate of discount convertible quarterly.

b) John buys a 10-year bond, of face and redemption amount, x, with 10 percent annual coupons at a price to yield 10 percent effective annual rate. The coupons, when received are reinvested immediately at 8 percent effective annual rate. Instantly after the receipt (and reinvestment) of the 4th coupon John sells the bond to Smith for a price that will yield effective annual rate i to the buyer. The yield rate that John earns on his investment is 8 percent effective annual value of i.

Question 2:

a) Discuss the Bayesian approach to credibility theory

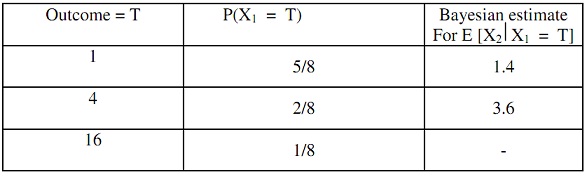

b) Let X1 be the outcome of a single trial and let E (X2 X1) be the expected value of the outcome of a second trial. You are given the information:

Find out the Bayesian estimate for:

E [X2 |X1 = 16].

Part B:

Question 3: What is the basic principle of equivalence employed in insurance? Do you think some modifications have come up recently in applying that principle due to inclusion of financial valuation practices? Provide reasons in support of your answer.

Question 4: Describe how the valuation in financial markets has influenced the valuation in insurance market. Do you think this influence has changed the principle of equivalence used in insurance problems?

Question 5: Describe the concept of ruin probability.

Question 6: Consider a binomial market model and discuss how a market in this formulation admits an arbitrage opportunity. As well, propose a trading strategy that explains the arbitrage.

Question 7: Write Short notes on:

i) Black-Scholes Theorem.

ii) Panjer Recursion.

iii) Reinsurance Pricing.

iv) Insurance Regulation.