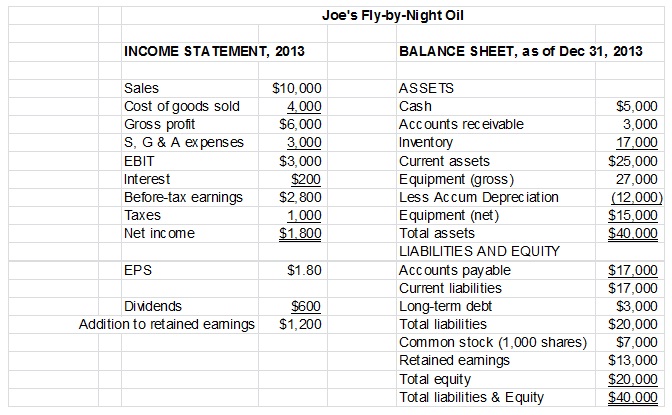

Question 1: What was Joe’s NOPAT in 2013?

Question 2: What was Joe’s Free Cash Flow (FCF) in 2013? (Note: For this question, assume Joe obtained no new plant and equipment or additional net working capital in 2013. Thus his Net Investment in Operating Capital (NIOC) for 2013 is $0.00.)

Question 3: Suppose you were an investor and you were considering whether to buy a corporate bond from Joe’s Corporation or a Municipal Bond from the city of St. Louis. Joe’s corporate bond has a yield of 7%. The St Louis city bond has a yield of 5%. The income from Joe’s bond is taxable. The income from the St Louis city bond is tax-free. If your effective tax rate is 30%, which bond would give you the higher after-tax yield?

Question 4: What was Joe’s Net Worth at the end of 2013?

Question 5: Why is the market value of a firm’s stock almost always higher than the book value of the firm’s stock as shown on the balance sheet?

Question 6:

a. Calculate Joe’s ROE for 2013.

b Construct a Du Pont equation (use the extended, or modified version shown in the Week 1, chapters 2 & 3 lesson notes) and comment on the sources of Joe’s ROE as revealed by the equation.