PROBLEM 1:

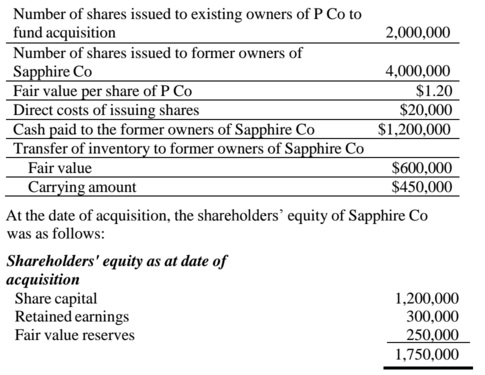

On 2 January 20x4, P Co purchased a 90% interest in Sapphire Co, a company that has an on-going research and development project. On this date, P Co entered into the following transactions.

The fair value of non-controlling interests on acquisition date was $660,000.

As at acquisition date, Sapphire Co had a research and development project that had the following expected outcomes:

Future event Present value of cash inflows Probability

Successful outcome $4,000,000 0.30

Not successful outcome $0 0.70

Prior to acquisition, Sapphire had accounted for the project expenditures as follows:

Accounting in Sapphire’s books prior to acquisition

Expensed research costs $500,000

Expensed development costs $100,000

Capitalized development costs $300,000

as at 31 Dec 20x3

The development expenditures incurred to acquisition date of $300,000 met the conditions for capitalization in Financial Reporting Standard (FRS) 38 Intangible Assets.

Sapphire Co successfully completed the research and development project on 31 December 20x5, after capitalising additional direct costs on the project of $1,000,000 since acquisition. The estimated economic life of the resultant intangible asset was 10 years. The group and Sapphire Co use the cost model to measure intangible assets.

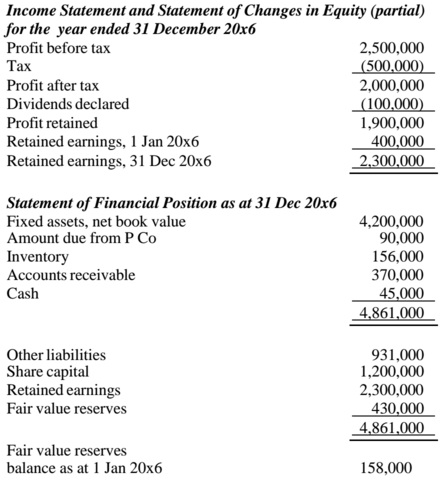

The financial statements of Sapphire Co for the year ended 31 December 20x6 are as follows:

Additional information:

1. On 1 July 20x5, Sapphire Co transferred excess equipment to P Co at an invoiced price of $1,500,000. Sapphire Co had purchased the equipment on 1 July 20x2 at an original cost of $900,000 when the useful life was 10 years. The remaining useful life on 1 July 20x5 was four years. Residual value was negligible.

2. On 1 July 20x6, P Co sold inventory to Sapphire Co at the transfer price of $400,000. The carrying amount of the inventory in P Co’s books prior to the sale was $300,000. Sixty percent remained unsold as at 31 December 20x6.

3. Recognize tax effects on fair value adjustments and other adjustments at the tax rate of 20%.

Required:

(a) Explain how the accounting for research and development costs differs for the legal entity and economic entity at acquisition date and after acquisition date in accordance with FRS 38 Intangible Assets.

(b) Prepare consolidation entries for the year ended 31 December 20x6, with narratives (brief headers) and workings.

(c) Perform an analytical check on the balance in Non-controlling Interests as at 31 December 20x6, showing the workings clearly.

(d) If the fair value of the remaining inventory sold by P Co to Sapphire Co was $190,000 as at 31 December 20x6, explain and show if the new information has any effect on your consolidation adjustments.

(e) State the amount of Intangible Asset that will be reported in Sapphire’s balance sheet and in P’s consolidated balance sheet, both as at 31 December 20x6.