Cost Estimation

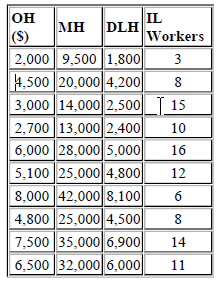

The CEO of Milton Manufacturing Company has asked you to develop a cost equation to predict monthly overhead costs in its production department. You have collected the following data for the last 10 months: Overhead costs (OH$) and the proposed independent variables: Number of machine hours worked (MH), number of direct labour hours (DLH) and number of indirect labour workers

(a) The CEO suggests that he has heard that the high-low method of estimating costs works fairly well and should be inexpensive to use. Write a response to this suggestion for the CEO indicating the advantages and disadvantages, including the calculation of a cost equation for this data using MH as the cost driver.

(b) Using Excel develop three scatter diagrams showing overhead costs against each of the proposed independent variables. Comment on whether these scatter diagrams indicate that linearity is a reasonable assumption for each.

(c) Using the regression module of Excel's Add-in Data Analysis, perform 3 simple regressions by regressing overhead costs against each of the proposed independent variables. Evaluate each of the regression results, indicating which is best and why. Provide the cost equations for those regression results which are satisfactory and from them calculate the predicted overhead in a month where there were 10,000 MH and 3,000 DLH worked.

(d) Selecting the two best regressions from part (c) conduct a multiple regression of overhead against these two independent variables. Evaluate the regression results. If there should be a problem identify the problem and draw conclusions about the best of the four regression results to use.

QUESTION 5 CVP Analysis and Linear Programming

Ace Electronics can produce four potential products: MP3 Players, CD Players, Digital Radios and DVD players. There are three major inputs for all products: electronic components, other components and assembly time.

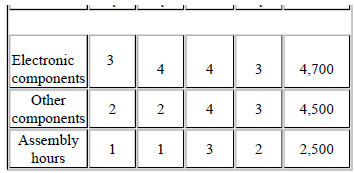

Electronic components cost $14 each, other components $10 each and assembly time $20 per hour. Consumption of theses inputs per unit of product together with total available monthly supply of components are shown below:

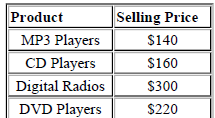

Selling price of the product are.

Fixed costs per month amount to $12,000.

(a) Calculate the contribution margin for each product.

(b) If management wishes to produce and sell Mp3s, Cds, Digital Radios and DVDs in the ratio 4:3:2:1, how many units of each should management plan to produce and sell in a month to earn a profit before tax of $70,000?

(c) Instead of producing the product mix in part (b), management wishes to use linear programming to find the profit-maximising mix. Write an LP model, and then use Excel's Solver to determine the optimum weekly mix and the resulting weekly profit before tax.

(d) Competitive pressures will probably force management to reduce the price for DVD players. What is the maximum price reduction that can be sustained such that the optimum mix calculated in part (c) remains optimum?

(e) What is the shadow price for Electronic Components? Explain to management how they might use this to increase profits? Calculate the upper limit for which this shadow price is valid. What happens when the upper limit is breached?

(f) Explain why linear programming is referred to as a resource allocation technique? Give examples of three different types of problems that can be solved via linear programming.