Question 1: The table below shows the components of M1 and M2 in billions of dollars for the month of December in the years 1995 to 2004 as published in the 2005 Economic Report of the President. Complete the table by calculating M1, M2, currency in circulation as a percentage of M1, and currency in circulation as a percentage of M2. What trends or patterns about M1, M2, currency in circulation as a percentage of M1, and currency in circulation as a percentage of M2 do you see? What might account for these trends?

|

Year

|

CIC

|

Traveler's Checks

|

Check Deposits

|

Money Market Funds

|

Time Deposits > $100,000

|

Savings Deposits

|

M1

|

M2

|

CIC as a % of M1

|

CIC as a % of M2

|

|

1995

|

$372.1

|

$9.1

|

$745.9

|

$448.8

|

$931.4

|

$1134.0

|

$1127.1

|

$3641.3

|

33.01%

|

|

|

1996

|

$394.1

|

$8.8

|

$676.5

|

$517.4

|

$946.8

|

$1273.1

|

$1079.4

|

$3816.7

|

36.5 %

|

|

|

1997

|

$424.6

|

$8.5

|

$639.5

|

$592.2

|

$967.9

|

$1399.1

|

$1072.6

|

$3816.7

|

39.5%

|

|

|

1998

|

$459.9

|

$8.5

|

$627.7

|

$732.7

|

$951.5

|

$1603.6

|

$1095.8

|

$4383.6

|

41.9 %

|

|

|

1999

|

$517.7

|

$8.6

|

$597.7

|

$832.5

|

$954.0

|

$1738.2

|

$1124.0

|

$4648.7

|

46.05%

|

|

|

2000

|

$531.6

|

$8.3

|

$548.1

|

$924.2

|

$1044.2

|

$1876.2

|

$1088.0

|

$4932.6

|

48.8%

|

|

|

2001

|

$582.0

|

$8.0

|

$589.3

|

$987.2

|

$972.8

|

$2308.9

|

$1179.3

|

$5448.2

|

49.3%

|

|

|

2002

|

$627.4

|

$7.8

|

$582.0

|

$915.5

|

$892.1

|

$2769.5

|

$1217.2

|

$5794.3

|

51.5%

|

|

|

2003

|

$663.9

|

$7.7

|

$621.8

|

$801.1

|

$809.4

|

$3158.5

|

$1293.4

|

$6062.4

|

51.3%

|

|

|

2004

|

$699.3

|

$7.6

|

$656.2

|

$714.7

|

$814.0

|

$3505.9

|

$1363.1

|

$6397.7

|

51.3%

|

|

There is an increase in both M1 and M2 from 1995 to 2004. The currency in circulation in 1995 was $1127.1 and by 2004 it had increased to $1363.1. The currency as a percentage of M1 in 1995 was 33% and by 2004 it had increased to 51.3%.

Question 2. Show the changes to the T-accounts for the Federal Reserve and for commercial banks when the Federal Reserve buys $50 million in U.S. Treasury bills. If the public holds a fixed amount of currency (so that all loans create an equal amount of deposits in the banking system), the minimum reserve ratio is 10%, and banks hold no excess reserves, by how much will deposits in the commercial banks change? By how much will the money supply change? Show the final changes to the T-account for commercial banks when the money supply changes by this amount.

The deposits in the commercial banks will increase by $50 million sort of like a check and balance since the bank’s assets and liabilities will both increase by that amount.

The money supply will change by $500 million because buying the $50 million in treasury bills will put them over the amount of reserves the banks carry over in excess.

Assets Liabilities

Treasury Bills = (- $50 Million)

Federal Reserve = + $50 Million Checkable deposits = + 500 million

Loans = + 500 Million

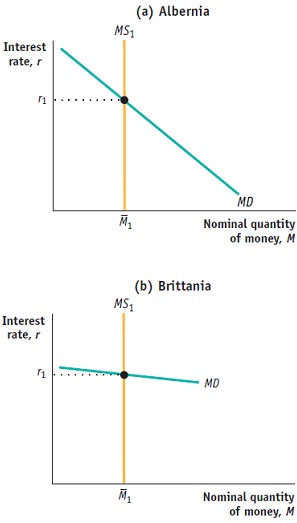

Question 3: An economy is facing the recessionary gap shown in the accompanying diagram. To eliminate the gap, should the central bank use expansionary or contractionary monetary policy? How will the interest rate, investment spending, consumer spending, real GDP, and the aggregate price level change as the monetary policy closes the recessionary gap?

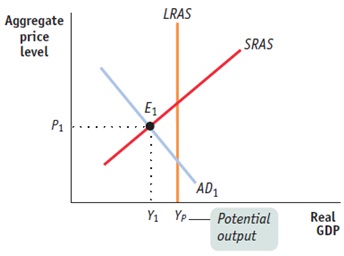

Question 4: The effectiveness of monetary policy depends on how easy it is for changes in the money supply to change interest rates. By changing interest rates, monetary policy affects investment spending and the aggregate demand curve. The economies of Albernia and Brittania have very different money demand curves as shown in the accompanying diagram. In which economy will changes in the money supply be a more effective policy tool? Why?