Problem 1: Gleason Advertising Company's trial balance at December 31 shows Advertising Supplies $6,700 and Advertising Supplies Expense $0. On December 31, there are $1,700 of supplies on hand. Prepare the adjusting entry at December 31, and using T accounts, enter the balances in the accounts, post the adjusting entry, and indicate the adjusted balance in each account.

Problem 2: At the end of its year, the trial balance of Easton Company shows Equipment $30,000 and zero balances in Accumulated Depreciation - Equipment and Depreciation Expense. Depreciation for the year is estimated to be $6,000. Prepare the adjusting entry for depreciation at December 31, post the adjustment to T accounts, and indicate the balance sheet presentation of the equipment at December 31.

Problem 3: On July 1, 2006. Orlow Co. pays $12,000 to Pizner Insurance Co. for a 3-year insurance contract. Both companies have fiscal years ending December 31. For Orlow Co., journalize and post the entry on July 1 and the adjusting entry on December 31.

Problem 4: Using the data in 5, journalize and post the entry on July 1 and the adjusting entry on December 31 for Pizner Insurance Co. Pizner uses the accounts Unearned Insurance Revenue and Insurance Reveneue.

Problem 5: The bookkeeper for Wooster Company asks you to prepare the following accrued adjusting entries at December 31.

1. Interest on notes payable of $400 is accrued.

2. Services provided but not recorded total $1,250.

3. Salaries earned by employees of $900 have not been recorded.

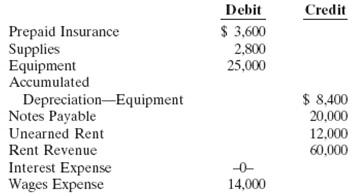

Problem 6: The ledger of Wetch Rental Agency Inc. on March 31 of the current year includes the attached selected accounts before adjusting entries have been prepared.

An analysis of the accounts shows the following:

1. the equipment depreciates $300 per month.

2. One-third of the unearned rent was earned during the quarter.

3. Interest of $500 is accrued on the notes payable.

4. Supplies on hand total $1,100.

5. Insurance expires at the rate of $200 per month.

Instructions:

Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are: Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expense.