INTRODUCTION:

Chameleon Limited is a London-based company in the midst of change. Recently, the comapny's finance director, Jimmy Beam left, as did the Chief Accountant, Jackie Daniels. Unfortunately this was shortly before the Income Statement and Balance Sheet relating to the latest financial year had been prepared. Additionally, the company is considering acquiring a small company, Petite Limited, which is a distribution business; there are concerns about the cash flow management of that company. To add to the woes, Jimmy and Jackie had agreed to prepare a short presentation to incoming graduate trainees, the focus of the presentation being the theoretical underpinning of the preparation of financial statements. The Chief Executive, Lyn-Lan Park, knows very little about financial matters and has asked, indeed begged, for your assistance.

SECTION 1:

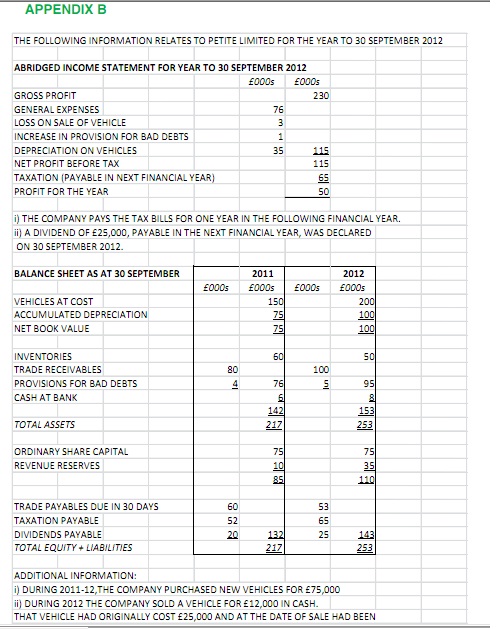

Lyn-Lan Park is under pressure from Chameleon Limited's auditors to produce the Income Statement for the year to 30 September 2012, and a balance sheet at that date. The relevant data required for the construction of these statements are detailed in Appendix A.

Using the data in Appendix A you are required to:

a) Construct and present the Income Statement and Balance Sheet.

SECTION 2:

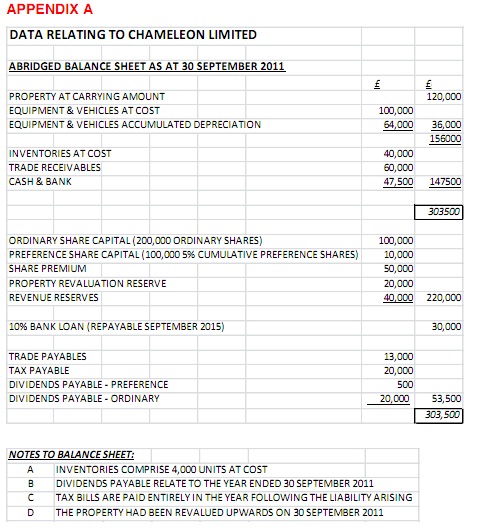

Chameleon Limited is considering acquiring Petite Limited. Lyn-Lan Park has heard rumours that the company has cash low issues. Petite Limited as a small company is obliged to register limited financial information with the regulatory authorities. Appendix B contains the latest financial information relating to Petite Limited.

Using the information in Appendix B you are required to:

a) Construct and present a cash flow statement in a form suitable for publication for the year ended 30 September 2012;

b) Advise Lyn-Lan Park on what is revealed by the statement.

SECTION 3:

Chameleon Limited has just started a graduate trainee scheme. The first students, recent MSc graduates from a well-known London university, have just joined. A presentation has been scheduled for mid-November 2012. Now that Jimmy and Jackie have left, Lyn-Lan Park has no presentation. Accordingly she has asked you to prepare a PowerPoint presentation.

You are required to:

a) Prepare a presentation using between TEN (10) and FIFTEEN (15) slides, relating to: The Theoretical Underpinning of Profit Measurement and the Valuation of Assets and Liabilities: Concepts and Conventions, and Issues in their Application.

CHAMELEON LTD TRANSACTIONS DURING YEAR ENDED 30 SEPTEMBER 2012:

1) New inventories, 30,000 units, were purchased on credit during the year for £360,000. Inventories are valued on a simple average basis. At the end of the year 2,000 units remained in stock. At the end of the year suppliers were owed £15,000.

2) Credit sales totalled £700,000 and cash sales amounted to £100,000. During the year a customer went bankrupt owing £30,000 and this debt is to be written off. At 30 September 2012 trade receivables owed £40,000 and a provision for bad debts to be created equivalent to 10% of year end trade receivables.

3) 1,000 units of inventory were damaged on last day of year and were written off.

4) The property had fallen in value by 10% by the end of September 2012.

5) Depreciation on equipment and vehicles is charged using the reducing balance rate, at twice the straight line % rate. Equipment and vehicles, all originally purchased on 1 October 2010, had an anticipated useful life of 5 years. During this latest financial year, a piece of equipment was sold for £1,500. It is the company's policy to not charge depreciation during the year of disposal. Its original cost was £10,000.

6) Wages and salaries amounted to £100,000 and were paid.

7) Other expenses were £10,000 per month, paid with one month's delay.

8) A legal claim for damages arising from an injury sustained by a customer during a visit to the company had been received. The claim is for £25,000.

9) Tax is estimated as being £25,000 for the year to 30 September 2012. During the year last year's tax and dividends payables amounts had been paid.

10) The preference dividend liability for the financial year was recognised on 30 September 2012. Additionally, an ordinary share dividend of £0.05 per share was declared. On that day £10,000 was repaid re: bank loan, and £3,000 interest was also paid.

11) Any changes in provisions for bad/doubtful debts and provisions for liabilities, profits/losses arising from disposals of non-current assets and impairment charges are included in the operating profit calculation.