REQUIRED:

Each group is required to read the case and address the issues raised at the end of the case. You are expected to conduct research relating to: customer profitability; competitive advantage/competitive strategy; activity based costing, activity based management and relate this back to the case study requirements when preparing your assignment. The assignment should be in REPORT format and NOT a collection of separate sections each written by individual students. The report should include: cover page, executive summary, table of contents, introduction, discussion (with appropriate sub-headings), conclusion, bibliography and appendices. Please ensure you include summary calculations in the body of the report and include detailed workings in appendices. Also, it is important that all articles, books and weblinks used for the assignment are properly referenced throughout the assignment. Hand written assignments are not acceptable.

SPECIFICATIONS: The suggested word limit for the assignment is strictly between 2,000-2,500 words including calculations, tables and figures but excluding bibliography and appendices. Assignments must be submitted typed (12p font in Times New Roman) and double-spaced, single-sided, on A4 paper. Where appropriate, the assignment must be adequately referenced, and a bibliography included. Students should keep a copy of their assignment.

CASE DETAILS:

In 1990, Illusional Optics began operations in the optical industry primarily by designing and manufacturing plastic, metal and titanium and semi frameless optical frames which it supplied to optical retail customers. Over the years the company has expanded its offerings to include optical lenses, contact lenses and sunglasses. Its optical lens products include: clear or tinted; plastic or glass; progressive or bi-focal lenses and these can be ordered with or without special coatings. The contact lens range includes: prescription; coloured prescription and non-prescription contacts. The sunglass products include plastic or metal; budget, middle and high end frames, which are all of excellent quality. Currently, the company’s retail customers can order optical frames, sunglasses, lenses and/or contact lenses.

The prices of the optical products are determined by a percentage mark-up on production cost. For example, titanium optical frames would be would generally be more expensive than the plastic optical frames and the price would also vary with the size of the optical frame i.e. a smaller optical frame has a lower selling price than that of a larger optical frame. Special trimmings to be included on sides of the arms of the frames further add to the manufacturing costs and also increases the production cycle of an order by 1.25 days. Even though demand for semi frameless optical frames has decreased substantially, the company still produces these as some of its existing customers still order a small volume every now and then.

Over the years Illusional Optics has invested in research and development leading to more innovative optical products namely more lightweight optical frames and sunglasses and also thinner high prescription lenses. Illusional Optics’ products, along with its exceptional customer service, have helped the company cement its position in the optical market. More recently however, the company’s profitability has not met expectations. In fact over the last two years (2015 and 2016), profits have decreased even though sales have increased. Figure shows the profitability figures for 2015 and 2016.

Figure: Illusional Optics Income Statements for 2015 and 2016

2015 2016

Sales $1,754,146 $1,798,000

COGS (1,306,839) (1,385,000)

Gross Profit 447,307 413,000

S & G Admin1 (277,331) (273,117)

Net Profit $169,976 $139,883

Many companies in the Optical Industry such as Illusional Optics have also been struggling to maintain profitability with a number of companies forced to drop some product lines or shut down completely owing to high costs which made them uncompetitive as competition in the industry has increased. Many companies that have survived have had to find ways of achieving a competitive advantage. Some companies have downsized their operations, but they are still finding it difficult to stay profitable; some companies have outsourced their production activities to cheaper overseas locations and other companies have switched to niche markets.

Currently Illusional Optics has 1,250 customers who pay for optical products by credit card and they take on average about sixty days to pay their account however, the customers can re-negotiate their credit terms if they need to. The customers however, differ in terms of the volume and type of order placed with Illusional Optics and some customers order a combination of all types of products. On this basis these customers have been categorised in one of five groups: Larger Department Stores (LDS), Smaller Department Stores (SDS), Larger Retail Optical Chains (LROC), Smaller Retailer Optical Chains (SROC) and Sole Traders (ST).

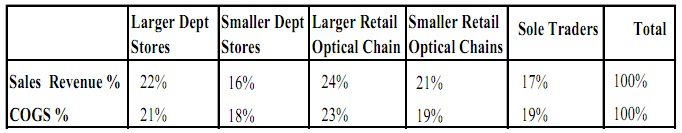

Table shows the percentage Sales Revenue and percentage Cost of Goods Sold by the five customer groups.

Table: Percentage Sales Revenue and Cost of Goods Sold for the Five Customer Groups.

In the most recent executive management meeting, Illusional Optics’ senior management met to discuss strategic planning issues for the company. During the meeting these managers agreed that the main strength of the Company is the quality of their optical products whilst the main weakness in recent years lies with customer service, especially in meeting scheduled deliveries. It was also noted that this was in conflict with the company’s newly proposed mission statement which stated that the company’s mission was “to provide a reasonable return to shareholders through being innovative in product design, through the provision of good quality products to customers with excellent customer service, and also providing on-time delivery at the lowest cost”. This proposed mission statement has not as yet been ratified by Illusional Optics’ Board of Directors and thus has not been implemented. As a result, the company’s management accounting and information system has not been modified to monitor progress towards these critical success factors. Also during the meeting the Marketing & Sales Manager, Max Wang pointed out that Illusional Optics can only reduce its prices if it can cut costs. He suggested that the company can reduce its quality inspection costs by reducing inspections and this would improve on-time delivery rates.

Overall, the management team agreed that the company needed to become more customer focused and this would help in improving company profit. In bid to ensure the company returns an increased profit in the next twelve month period, Illusional Optics’ management team decided that the profitability of its customers in the five customer categories need to be determined and analysed, as at present this is not possible. A few managers believe that some of the customers generate high profits whilst other customers are “loss” customers. These managers agreed that using Activity Based Costing (ABC) information would facilitate this analysis and that Mia Logan the company accountant, and her team were best positioned to do this analysis. Mia had substantial knowledge and experience with Activity Based Costing (ABC) and she knew exactly how she was going to manage this task. She gathered her team together and explained to them what she proposed they do for this analysis. Basically, they were going to design a customer profitability system based on ABC. They started by firstly compiling information about the activities undertaken by the company in servicing their customers. They interviewed the company’s staff involved in the various processes and they began to get a better understanding of the activities undertaken by staff. The team primarily focused their attention on the selling and general administration activities. In previous reports the selling and general administration expenses were applied to each customer based on their percentage of sales revenue for the year. Now Mia decided that the team needed to isolate those activities that directly related to servicing customers (i.e. those activities which varied with each customer) and those which did not. The activities which directly related to servicing customers were classified as customer related whilst the rest were classified as general administration. The team’s focus was mainly on the customer related activity costs and only these would be included in the customer profitability reporting system. The general administration costs would be allocated as ten percent of customer gross margin.

Mia and her team identified a number of customer related activity costs which totalled $231,817. These included: processing normal orders and special orders, invoicing of customers, sales staff contact with customers, customer visits by sales staff, and packaging and handling of optical products and delivery. Processing normal orders involved manual computer entry of customer details if a customer telephoned the order through, otherwise if the order had been faxed this would be scanned through the computer in the order file format required. These orders involved straightforward ordering of existing stock products without these being customised in any way. Mia and her team concluded that the cost of processing these normal orders was $49,500.

Processing special orders accounted for $33,000 of total customer related activity costs identified. The work involved here was similar to processing normal orders above. However, as these orders were for products to be customised in some way, more detail from the customer was required when recording these. For example, a customer may order a pair of sunglasses from the available range but may request the lenses be tinted in a different colour to the standard tint they normally are produced and for these to be coated with a special anti-scratch coating.

In addition to the above, Mia and her team discovered there were different customer ordering patterns that took place. Many of Illusional Optics’ customers would usually order optical frames and sunglasses to keep stock on hand to sell and would re-order once the stock decreased, however in many instances some customers would not keep stock of the more expensive frames (optical and sunglasses) and only have display models. This meant that these customers would order such types of frames as needed (i.e. when a customer requested it). In terms of optical lenses, some customers ordered these as the need arose (i.e. after an eye examination where the order was for a pair of optical frames with prescription lenses). Other customers would order a stock of lenses to have on hand whilst some customers would do a combination of both (i.e. order on an as needs basis and also have stock of lenses on hand). The same was observed with respect to contact lens orders. All in all they found that some customers had fewer smaller order sizes and ordered less frequently when compared to the other customers.

Customer sales visits involved Illusional Optics’ staff going to new and existing customers’ premises and showing them the optical products available in addition to attending to other sales related issues whilst there. Also, the sales staff would also do the window displays of the products that Illusional Optics' customers would sell. Mia and her team determined that customer sales visits accounted for $39,710 of the total customer related activity costs.

In addition to the sales visits, customers could contact the sales staff for sales related issues (i.e. to enquire whether a range of sunglass frames could be bought on consignment). Tending to sales related issues involved sales related phone calls, faxes and, emails and it was determined that the cost of attending to sales related issues totalled $32,175.

All optical products ordered by Illusional Optics’ customers would be packaged and delivered in cartons. Package and handling costs accounted for $11,000 of customer related activity costs. Each delivery, to a customer, would consist of at least one carton. In some instances a carton could contain more than one normal or special order from a customer. The number of orders packed in a carton depended largely on, whether the order was a normal one (receive within 7 days) or an urgent order (receive within 1 day) and to some extent on the size of the order. For example, smaller non-urgent orders meant that fewer containers were packaged and delivered to the customer over the year and vise-versa if a customer placed larger non-urgent orders. If an order was urgent, then there would be one carton packaged for each urgent order and delivered straight away, hence this could increase the number of containers delivered to a customer. Urgent orders could also increase delivery expenses as these tended to increase the number of deliveries made to a customer.

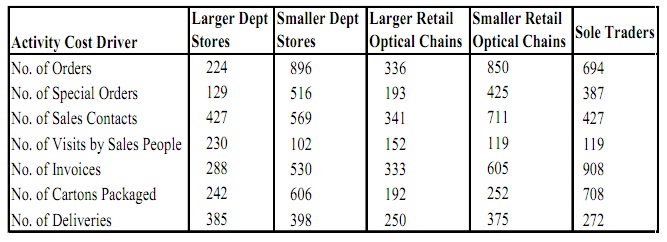

Overall, delivery expenses were determined to be $18,480. Illusional Optics’ customers were invoiced on a regular basis based on the invoices which were raised each time a customer order was processed. Invoicing costs made up the remaining customer related activity costs that Mia and her team had identified as part of their analysis. They also identified a number of activity cost drivers to use as part of their analysis. Table summarizes these activity cost driver amounts for 2016.

Table: Activity Cost Driver Amounts for 2016

REQUIREMENTS:

The senior managers at Illusional Optics have approached your project team and have asked for advice on the current situation and the future direction of the company. You are expected conduct research and analysis to prepare a report for the next executive management meeting which addresses the requirements below:

1. Your project team is required to present to Illusional Optics’ senior management a recommendation of the best strategy you believe that the company should adopt in order to be competitive. In order to achieve this, your team should conduct research into the fundamental ways in which companies can achieve a sustainable competitive advantage. Specifically your team is required to:

(i) Discuss in detail two of these strategies, and for each one, identify and discuss in detail two Australian or US, publicly listed companies (include the company code of each) that have succeeded in using the particular strategy, the reason why the strategy was chosen and implemented by the company, and how this has been effective for each company.

(ii) Using your research from Requirement 1(i), present the senior management team with a recommendation of the best strategy you believe Illusional Optics could adopt in order to be competitive and why this is the best one. Your discussion should include and justify what you believe to be the critical success factors in achieving this strategy. Explain also why the other strategy, as identified by your research above, may not be as effective for the company as the one recommended.

2. Illusional Optics’ management team have agreed that the company needs to become more customer focused and have asked your project team to research this further with respect to customer profitability analysis. Discuss in detail how customer profitability analysis can be used by companies in increasing customer focus. You should also identify and discuss in detail two Australian or US, publicly listed companies (include the company code of each) which have implemented customer profitability analysis highlighting how these companies have used this approach to become more customer focused and discuss what the overall outcome has been for each company.

3.

(i) Design a customer profitability system based on Activity Based Costing (ABC) for Illusional Optics. You will need to describe in detail the elements of this costing system justifying the activity cost pools and activity cost drivers included. Include in your answer the activity cost driver rates.

(ii) Using the new ABC customer profitability system your group has designed calculate and show the profitability of Illusional Optics’ five customer groups.

4. Based on your group’s ABC customer profitability information, explain in detail the differences in the profitability of Illusional Optics’ five customer groups with an emphasis on analysing the customer related activity costs.

5. Based on your project team’s research and also on your customer profitability analysis for Illusional Optics, identify and discuss in detail three strategic issues that may arise for the company.