Question 1:

For each of the following independent situations, determine (1) whether the bonds sold at face value, a premium, or at a discount, and (2) whether interest expense recognized each year for the bonds was less than, equal to, or greater than the amount of interest paid on the bonds.

a. Bonds with a stated rate of 10 percent were sold to yield an effective rate of 8 percent.

b. Bonds with a stated rate of 7 percent were sold to yield an effective rate of 7 percent.

c. Bonds with a stated rate of 6 percent were sold to yield an effective rate of 11 percent.

Question 2:

Rocky Road Company sold $5 million of six-year six percent debentures (bonds) on January 1, 2009. The bonds sold to yield an effective rate of seven percent. Interest is paid annually on December 31st.

a. What is the price of the bonds? (Show calculations clearly.)

b. What would be the price of the bonds ifthey were sold to yield a real rate of five percent? (Show calculations clearly.)

Question 3:

Lindon Processing Company has been taking bids for four new processors. Martin Steel Goldbaum Equipment has offered to sell them a processor for $29,000 each. In addition, Martin would finance the transaction through a capital lease over the expected ten-year life of the processor with no money down. No mention of the size of the required year-end lease payments has been made yet, but Lindon knows that Martin will expect an eight percent return on the lease arrangement. Assume that Lindon accepts this option when answering the following questions. (Show detailed calculations.)

a. What will be the amount of each annual year-end lease payment? (Round to a whole number.)

b. What amount will Lindon capitalize as an asset on its balance sheet for the processors and for the lease obligation?

c. What total interest amount will Lindon pay over the life of the lease for financing?

d. What portion of the first payment will be attributable to interest?

Question 4:

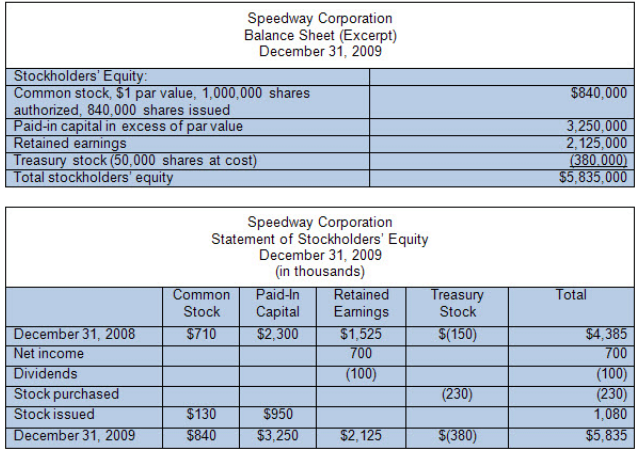

Speedway Corporation manufactures automobile steering wheels. Selected portions of the company's recent financial statements are given below:

a. Using the above data, what is the total contributed capital at year-end? (Show computations.)

b. How many shares of common stock were outstanding at year-end? (Show computations.)

c. What dollar amount of treasury stock did Speedway hold atyear-end?

d. What dollar amount of treasury stock did Speedway repurchase during the year?

e. How much common stock did the company issue?

f. What was the amount of dividends paid during the year?

g. How much net income came from financing activities associated with shareholders' equity during the current year, excluding the effect of net income? (Show computations.)