Question1. Compute yield to maturity for a 7%, semi-annual coupon payments bond that has five years left to maturity & is currently trading at $900.

Question2. Compute holding period rate of return for a zero coupon, ten-year bond if it was bought at the time it was issued for $350 and sold 4 years later when the market rate of return was 9.5 %.

Question3. A bond was issued at par, carried a coupon of 6 % and had 20 years to maturity. Coupon payments are made semi-annually. What will be the price of this bond three years from the issue date if the issuer is perceived to be less unsafe eliminating the require for an extra 0.3% in default risk premium?

Question4. Which bond would experience the most change in price if the interest rates went from 8% to 7%? Describe with computation:

a. 10 year 7% coupon bond:

b. 10 year zero coupon bond

c. $1000 perpetuity

d. 30 year zero coupon bond

Question5. Compute YTM & YTC for the following bond:

a. Issue date 1-1-00

b. Maturity date: 1-1-20

c. Today’s date: 1-1-03

d. Call protection until 1-1-05

e. Call premium= interest for six months

f. Coupon rate 7.5% paid annually

g. Current price $934.42

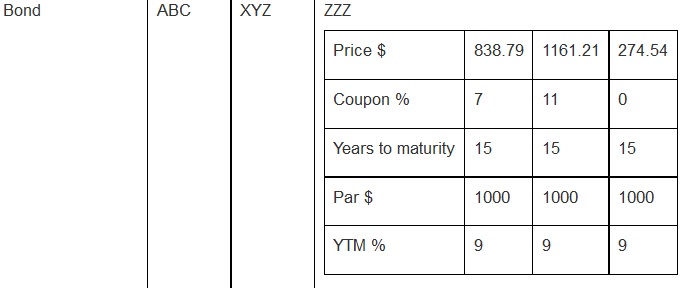

Question6. Make up three distinct assumptions about the investor. They could relate to age, gender, income tax rate, goal for investing, amount available for investing, investment horizon, and attitude to risk. One of the assumptions must be about the tax rate applicable to the investor. Which of the following bonds would serve the needs of the investor best?