I. Multiple Choice:

Question 1. In 2000 Country A's real GDP per person was $20,000 per person, while country B's real GDP per person was $10,000 per person. For this problem assume that population in both countries is constant over time and does not change. Assume that the growth rate of real GDP in Country A is a constant 5% a year while the growth rate of real GDP in Country B is a constant 10% a year. Using the rule of 70, in what year will the real GDP per person of both countries be the same?

a. 2021

b. 2014

c. 2028

d. 2007

Question 2. The government of Spain has increased its debt substantially in the past decade. The loanable funds market model you learnt in class predicts that

a. The interest rate in Spain will increase and investment will decrease.

b. The multiplier effect will generate an increase in GDP.

c. Production will not be affected because technology, labor, and capital were not modified by this government policy.

d. Aggregate demand will increase in the short run.

Question 3. Last year the leaders of the G20 group of big economies led a global initiative, pledging fiscal stimulus worth a combined 2% of world GDP. Thanks to Greece's sovereign-debt crisis, which has terrified politicians, stimulus is out and deficit reduction is in. According to the models you have studied in class this summer

a. The initial policies follow the classical model and the more recent concerns are closely related to the Keynesian model.

b. The initial policies follow the idea that in the short run an increase in AD will help increase GDP and the more recent concerns are closely related to the loanable funds market where government spending crowds out investment.

c. The initial policies are oriented to achieve the long run equilibrium of the economy by increasing aggregate supply and the more recent concerns are closely related to the loanable funds market where government spending crowds out investment.

d. Both ideas are essentially capturing the idea that in the long run we are all dead.

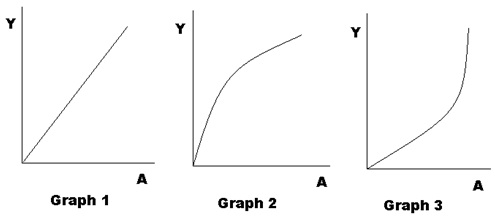

Question 4. The economy of Silicon Valley is characterized by increases in technology that generate exponential growth in production. Which of the graphs above, where production is (Y) and Technology (A), best describes this situation?

a. Graph 1

b. Graph 2

c. Graph 3

d. Graphs 1 and 2

Question 5. The aggregate demand curve for an economy shows the relationship between the aggregate price level and the level of GDP. The aggregate demand curve is downward sloping because of:

a. the wealth effect and multiplier effect.

b. the interest rate effect and the multiplier effect.

c. the wealth effect and the interest rate effect.

d. the multiplier effect.

Question 6. In the Keynesian model, if taxes increase while holding everything else constant, then the equilibrium output

a. will increase.

b. will decrease.

c. will not change.

d. may increase, decrease, or remain unchanged.

Use the following Keynesian Model of a closed economy to answer the next two questions. Assume AE = Y for all years. C is consumer spending, S is private saving, NT is net taxes, I is investment spending, G is government spending, a is autonomous spending, and b is the marginal propensity to consume.

o Y= C+S+NT

o AE= C+I+G

o C= a +b(Y-NT)

|

Year

|

Y

|

NT

|

C

|

I

|

G

|

S

|

|

2004

|

1000

|

100

|

730

|

|

80

|

|

|

2005

|

1200

|

150

|

|

|

100

|

215

|

|

2006

|

1500

|

200

|

|

|

110

|

|

Question 7. From the information above it can be said that:

a. The multiplier of this model is 0.7 and the autonomous consumption is 100.

b. The growth of consumption is 105.

c. In 2004 and 2006 the government is running a deficit.

d. The marginal propensity to consume is 0.7 and consumption increased by 105 units from 2004 to 2005.

Question 8. It can be said that investment in this economy

a. Crowded out between 2004 and 2006.

b. Is indeterminate given the information that has been provided.

c. Increased between 2004 and 2006.

d. Both answers (a) and (b) are correct.

Question 9. Which of the following will not shift the aggregate demand curve?

a. A change in monetary policy.

b. A decrease in the wealth in society.

c. A rising optimism in the performance of the economy.

d. A change in oil prices.

Question 10. Which of the following statements is false?

a. Keynes believed that the economy would reach equilibrium in the long run.

b. Say's law assumes that markets clear.

c. Economic growth makes everyone better off.

d. There is a fraction of consumption spending that is independent of individual income.

Question 11. Country X is at its long run equilibrium. Its government decides to increase its spending. At the same time country X experiences a positive technological improvement. In the framework of the Long Run and Short Run Aggregate Supply model:

a. Prices and production increase in the short run and prices at the new short run equilibrium are greater than prices at the new long run equilibrium.

b. Prices are indeterminate in the short run while production increases in the short run. In the long run production increases but we do not know if prices in the long run are greater than, less than or equal to their initial level.

c. Prices and production increase in the short run and prices at the new short run equilibrium are greater than prices at the new long run equilibrium.

d. Prices and production increase in the short run and production at the new long run equilibrium is greater than production at the new short run equilibrium.

Question 12. Suppose there is an increase in immigration to country X. At the same time, an earthquake destroys valuable plant and equipment in the country (assume that this loss in capital does not affect the demand for labor). Fortunately, the incident did not result in any casualties. Within the framework of the classical model:

a. wages will increase and productivity of capital will increase.

b. wages will decrease and productivity of capital will increase.

c. wages will increase and productivity of capital will decrease.

d. wages will decrease and productivity of capital will decrease.

|

Country

|

Population

|

Employment

|

Output(Real GDP)

|

|

Ecuador

|

80 million

|

40 million

|

$ 300 billion

|

|

Venezuela

|

60 million

|

30 million

|

$ 200 billion

|

Question 13. From the chart above it can be said that:

a. Ecuador has higher labor productivity and Venezuela has a higher standard of living.

b. Ecuador has lower labor productivity and Venezuela has a higher standard of living.

c. Ecuador has higher labor productivity and a higher standard of living.

d. Ecuador has lower labor productivity and a lower standard of living.

Question 14. Country X, which is an exporter of toys, is at its long run equilibrium. Suddenly, the country experiences a reduction in the cost of raw materials used in toy production. At the same time, the monetary authorities in country X decide to increase the money supply. In the framework of the Long Run and Short Run Aggregate Supply model:

a. Production in the short run is indeterminate, prices in the short run increase and prices in the long run are greater than prices in the short run.

b. Production in the short run increases, prices in the short run are indeterminate, and prices in the long run are greater than prices in the short run.

c. Production in the short run is indeterminate, prices in the short run increase and prices in the long run are lower than prices in the short run.

d. Production in the short run increases, prices in the short run are indeterminate, and prices in the long run are lower than prices in the short run.

Use the information above to answer the next question.

The production function and labor market of country Z are determined by the equations:

Labor Supply = 50

Labor Demand = 100 - W

Y = 10K1/2L1/2

K = 2

Question 15. Suppose labor supply increases to 72 units. Then

a. Wage decreases 22% and productivity decreases.

b. Wage decreases 44% and labor productivity decreases.

c. Wage increases 22% and labor productivity increases.

d. Wage increases 44% and labor productivity increases.

Question 16. Economic fluctuations (business cycles):

a. Measure changes in the number of businesses started.

b. Measure fluctuations in the Dow Jones Industrial Average.

c. Result in businesses hiring fewer resources.

d. Reflect fluctuations in the level of economic activity relative to a long term trend.

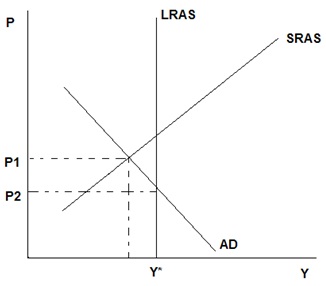

Question 17. The above diagram shows the long run aggregate supply curve (LRAS), the short run aggregate supply curve (SRAS), and the aggregate demand (AD) for an economy. The economy is not currently at the long-run equilibrium, Y*. Which of the following statements is true?

a. In the long run, if there is no fiscal or monetary policy intervention in this economy, aggregate production will increase and the aggregate price level will decrease.

b. Implementation of fiscal policy in the form of lower taxes will in the short run increase aggregate production and decrease the aggregate price level.

c. Implementation of fiscal policy in the form of increased government expenditure will in the short run have no effect on aggregate production but will cause the aggregate price level to increase.

d. In the long run, if there is no fiscal or monetary policy intervention in this economy, long run aggregate production will stabilize at a level lower than Y*.

Use the information below to answer the next two questions.

|

Real interest rate

(percent per year)

|

Planned Investment

(billions of

2010 dollars)

|

Private saving

(billions of

2010 dollars)

|

Net taxes

(billions of 2010 dollars)

|

Government purchases

(billions of 2010

dollars)

|

|

5

|

600

|

200

|

400

|

200

|

|

6

|

500

|

300

|

400

|

200

|

|

7

|

400

|

400

|

400

|

200

|

|

8

|

300

|

500

|

400

|

200

|

|

9

|

200

|

600

|

400

|

200

|

Question 18. When the real interest rate is 8 percent, then the

a. total supply of funds is equal to $500 billion and budget surplus is $200 billion .

b. total supply of funds is equal to $700 billion and budget deficit is $200 billion.

c. total supply of funds is equal to $700 billion and budget surplus is $200 billion.

d. total supply of funds is equal to $500 billion and budget deficit is $200 billion.

Question 19. The equilibrium interest rate is

a. 6 %

b. 7 %

c. 8 %

d. 9 %

Use the information below about a closed economy to answer the next question.

AE = Y in equilibrium

G = 20000

I = 14000 - 40000r where r is the interest rate expressed as a decimal

T = 2000

C = 8000 + .5(Y-T)

Money Supply = 5000

Money Demand = 15000 - 200000r

Question 20. For the economy described above:

a. Y = 42000 and r = .5.

b. Y = 78000 and r = .05.

c. There is a positive relationship between the money supply and the interest rate.

d. I = - 6000.

II. Written Exercise:

The economy of the People's Republic of Comala is described by the following relationships:

Aggregate Supply: P = Y + w

Aggregate Demand: P = Y - AE + 510

AE = C + I + G

C = 10 + .5(Y-T)

I = 100

G = 100

T = 100

Labor Supply = 280

W = 290 - Labor Demand.

a. In Comala, the labor market determines the employment of labor and the wage rate that labor receives. Find equilibrium wages and labor for this economy.

b. Given the equilibrium amount of labor and wage rate you found in part (a) find AE, P, C, and Y in Comala. [Hint: since the labor market is determining the level of labor and the wage rate this may lead to a level of production that is initially not equal to the level of spending in Comala.]

c. The Keynesian model suggests that there is an equality between aggregate expenditure and production in the economy that is achieved through inventory adjustment. What will happen to inventories and production in this economy given your findings in part (b) in order for aggregate expenditure to equal aggregate production in this economy?

d. For the goods market to be in equilibrium, it must be the case that aggregate production equals aggregate expenditure. Given that this must be true, find the equilibrium level of Y, P, w, and L for this economy.