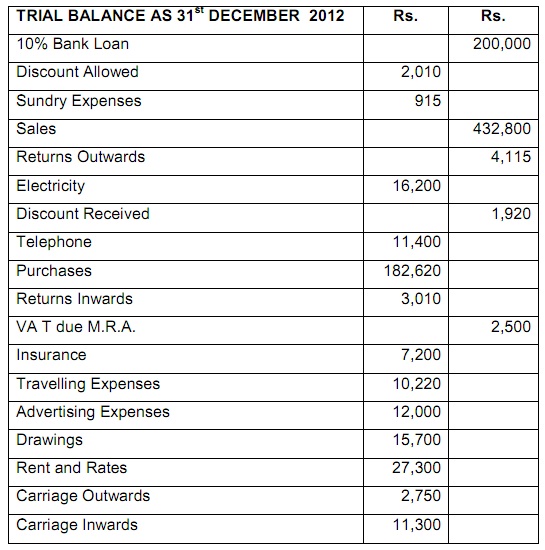

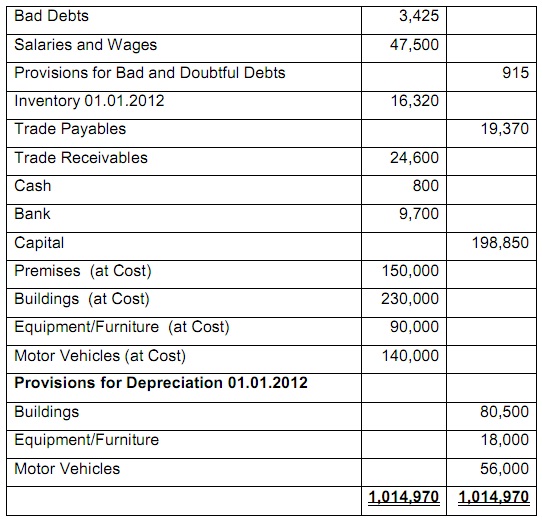

Mr. Peterpan holds a retail shop in Cure-pipe. With the help of a friend he has extracted the given balances as at 31st December 2012 from his Accounting records however is not able to make his Financial Statements for the year then ended.

He has solicited your assistance for that.

You were as well given with the mentioned additional information that concerned the year under review:

A) The Closing Inventory had cost Rs 20,200. These comprised some goods costing Rs 2,500 however a Net Realiasable Value of Rs 1,800 had.

B) Mr. Peterpan took goods costing Rs 3,000 for his personal use.

C) The Insurance Policy is for one year ending March 2013.

D) A Debtor for Rs 600 has immigrated to Canada devoid of leaving any address.

E) The Provision for Bad and Doubtful Debts is to be adjusted to 5% of Trade Receivables.

F) The Bank Loan was contracted on 1st July 2012 and is refundable in 10 equivalent annual installments starting one year after the contractual date.

G) The Depreciation Policy of Mr. Peterpan is detailed here under:

a) Premises: No Depreciation

b) Buildings: 5 % Straight Line Basis;

c) Equipment/Furniture: 15% on Cost

d) Motor Vehicles: 20% Reducing Balance Basis.

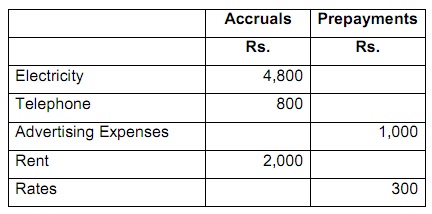

H) Accruals and Prepayments at 31.12.2012 were:

Question 1: Required:

1) Make Mr. Peterpan’s Income Statement for the Year ending 31st December 2012.

2) His Balance Sheet as at that date.

Question 2: According to you, have you made Mr.Peterpan’s Financial Statements on a Going Concern basis? Support your answer with two arguments.

Question 3: List down four users of Accounting information and Financial Statements.