Financial Analysis of Long Term development Project:

The government of the Philippines applied for $3.0 million. Loan from the Asian Development Bank. $2.5 million will be used for repairs and extension of the existing irrigation system and $.5 million will be used to purchase fertilizer to increase rice production.

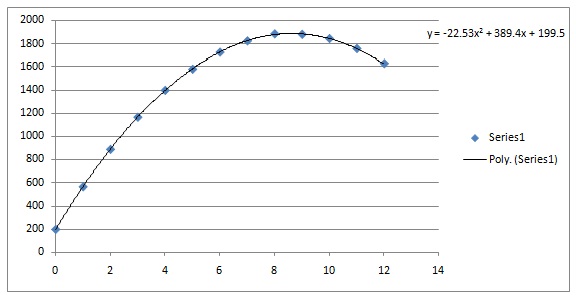

The production response of rice to different levels of fertilizer application is shown below.

Fert. in tons/ha 0 1 2 3 4 5 6 7 8 9 10 11 12

Pronds in kgm per ha 200 566 888 1164 1400 1582 1724 1820 1880 1876 1840 1755 1630

The above input/output schedule can be stated in the form of a quadratic equation and also shown as a graph below.

Assume that you are contracted by the Asian Development Bank to conduct the financial appraisal of the project for a fee of $100,000.

Also assume that the price of fertilizer is $100/ton and the price of rice is $1.0/kgm. If the $3.0 million is approved, the loan will be repaid over a twenty five year period at 5% interest with the first 5 years as grace period.

Your job as a consultant is to determine the financial soundness of the project by estimating

1. The net present value of the stream of costs, revenue and cash flow

2. The benefit cost ratio of the project

3. The internal rate of return of the project

Based on the results of the above financial indicators, would you recommend approval or disapproval of the loan application?