1.Suppose a five-year, $1000 bond with annual coupons has a price of $900 and a yield to maturity of 6%. What is the bond’s coupon rate?

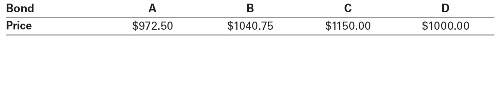

2.The prices of several bonds with face values of $1000 are summarized in the following table:

For each bond, state whether it trades at a discount, at par, or at a premium.

3.Explain why the yield of a bond that trades at a discount exceeds the bond’s coupon rate.

4.Suppose a seven-year, $1000 bond with an 8% coupon rate and semiannual coupons is trading with a yield to maturity of 6.75%.

a. Is this bond currently trading at a discount, at par, or at a premium? Explain.

b. If the yield to maturity of the bond rises to 7% (APR with semiannual compounding), what price will the bond trade for?