Assignment:

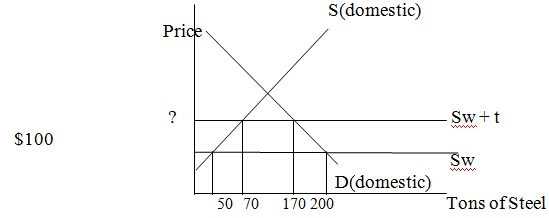

Use the following graph to answer the questions below.

a. Assume that the world price of steel is $100 per ton, and that the United States is a small country in the world market of steel. Under free trade, how much of Steel is consumed in the US? How much do the domestic producers produce? How much is imported?

b. Assume that the US imposes a 40 percent tariff on steel imports. Show the effects on the graph. What is price after tariff? How much is imported after tariff? How much do domestic producers supply?

c. Explain the welfare effects of tariffs by computing and comparing the individual effects in this example: effect on the domestic producers; effect on the domestic producers (known as the redistributive effect); production inefficiency effects; revenue effects; and consumption inefficiency effects. (Explain by calculating dollar values of the relevant areas for each effect).

d. Calculate dead weight loss from tariff in the graph above.

e. If, instead of the tariff, a quota were used by the United States, would dead weight loss be smaller or larger? Explain your answer.

Sample Questions:

1. If the consumption effect of a tariff were 50 units and the production effect of a tariff were 40 units, then imports would

a) Increase by 10 units.

b) Increase by 90 units.

c) Decrease by 90 units.

d) Decrease by 10 units.

2. If a tariff in a small country produces a deadweight loss of $60, reduces consumer surplus by $200, and increases producer surplus by $40, which of the following is correct?

a) National welfare falls by $220.

b) National welfare falls by $160.

c) Tariff revenues equal $100.

d) The price of the imported good must have fallen.

3. Which of the following must be true if a large nation imposes a tariff on an imported good?

a) The price received by domestic producers will fall.

b) The price received by foreign producers will fall.

c) Domestic consumers will gain.

d) The nation will gain.

4. A large nation imposes a tariff on an imported good, which causes the world price to fall by $4. At the new world price the large nation has deadweight losses of $500 and imports of 300. Which of the following must be true?

a) The large nation has gained.

b) Domestic producer surplus has fallen.

c) Domestic consumer surplus has increased.

d) Total tariff revenues must be less than the deadweight loss.

5. If a tariff of $10 per unit reduces the world price by $4, then

a) The nation imposing the tariff must be a small nation.

b) Domestic consumers pay $6 of the $10 per unit tariff.

c) Foreign producers pay $6 per unit of the $10 per unit tariff.

d) The nation imposing the tariff must necessarily lose.

6. Given that the imposition of a tariff will improve the welfare of a large nation, which of the following is true?

a) World welfare will increase if all large nations impose the tariff.

b) The large nation's gains are equal to its trading partners' losses.

c) World welfare will fall.

d) Large nations should impose a prohibitive tariff.

7. If a nation imposes a tariff on laptop screen, an important input in the production of laptops then

a) The nominal tariff on laptops will increase.

b) The rate of effective protection on computer screen will decrease.

c) The rate of effective protection on laptops will decrease.

d) Employment in the laptop producing industry will increase.