Part I

1. How is job costing in service organizations different from the job costing in manufacturing environments?

2. If costs increase from one period to another, will costs which are transferred out of one department under FIFO costing be higher or lower than costs which are transferred out using weighted average costing? Why?

3. Jim, VP of Marketing, says company must not adopt activity-based costing as it would result in costs of some of the products going up, but the market would not allow for raising prices. How will you respond?

Part II. Problem Material.

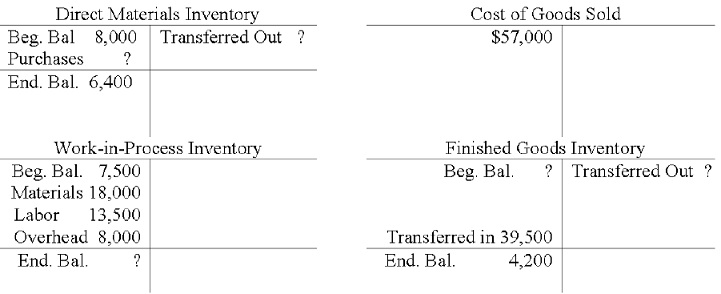

1. Financial records for Lee Manufacturing Company have been destroyed in a fire. Following information has been got from a separate set of books maintained by a cost accountant. Cost accountant now asks for your assistance in computing the missing amounts.

a) Calculate the amount of materials purchased?

b) Calculate the value of ending Work-in-Process inventory balance?

c) Calculate the value of beginning Finished Goods Inventory?

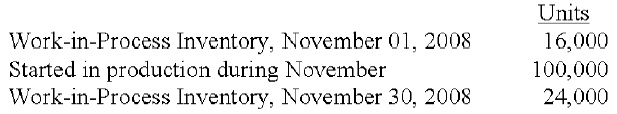

2. Kimbeth Manufacturing uses process costing to control costs in manufacture of Dust Sensors for the mining industry. Following information pertains to operations for November 2008. (Adapted from June 1995 CMA Exam.)

Beginning inventory was 60% complete as to materials and 20% complete as to conversion costs. Ending inventory was 90% complete as to materials and 40% complete as to conversion costs.

Costs pertaining to November are as follows:

Beginning inventory: direct materials, $54,560; direct labor, $20,320; manufacturing overhead, $15,240 Costs incurred during the month: direct materials, $468,000; direct labor, $182,880; manufacturing overhead, $391,160

a) What is equivalent unit cost for materials assuming Kimbeth uses first-in, first-out (FIFO) process costing?

b) What is equivalent unit cost for the conversion costs, assuming Kimbeth uses firstin, first-out (FIFO) process costing?

c) What are total costs in the ending Work-in-Process Inventory, assuming Kimbeth uses first-in, first-out (FIFO) process costing?

d) What is equivalent unit cost for materials, assuming Kimbeth uses weightedaverage process costing?

e) What is equivalent unit cost for conversion costs, supposing Kimbeth uses weighted-average process costing?

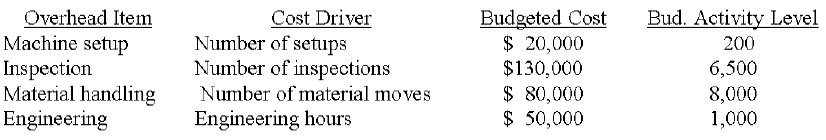

3.

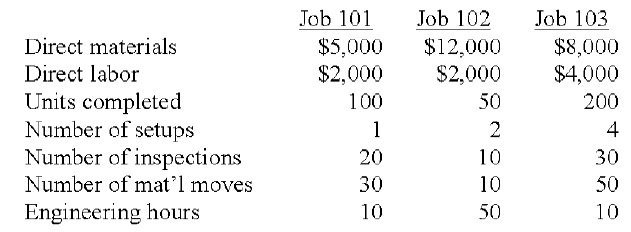

Budgeted direct labor cost was $100,000, and budgeted direct material cost was $280,000. The following information was collected on three jobs that were completed during the year:

a) If company uses activity-based costing (ABC), how much overhead cost must be assigned to Job 101?

b) If company uses activity-based costing (ABC), Estimate the cost of each unit of Job 102?