Assignment:

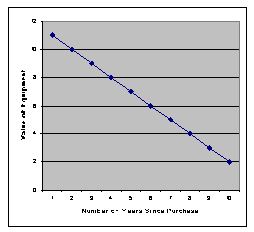

To reduce their taxes, many businesses use the straight-line method of depreciation to estimate the change in value over time of equipment that they own. The graph shows the value of equipment (in thousands of dollars) owned from the time of purchase to 10 years later.

(1) What is the estimated average annual rate of depreciation on this equipment?

(2) If the owner wants to sell the equipment when it is worth exactly half its original value, in what year must the owner sell?

Provide complete and step by step solution for the question and show calculations and use formulas.