Assignment:

John Irish, CFA, is an independent investment adviser who is assisting Alfred Darwin, the head of the Investment Committee of General Technology Corporation, to establish a new pension fund. Darwin asks Irish about international equities and whether the Investment Committee should consider them as an additional asset for the pension fund.

Q1. Explain the rationale for including international equities in General's equity portfolio. Identify and describe three relevant considerations in formulating your answer.

Q2. List three possible arguments against international equity investment and briefly discuss the significance of each.

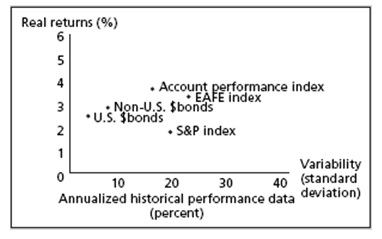

Q3. To illustrate several aspects of the performance of international securities over time, Irish shows Darwin the accompanying graph of investment results experienced by a U.S. pension fund in the recent past. Compare the performance of the U.S. dollar and non-U.S. dollar equity and fixed-income asset categories, and explain the significance of the result of the account performance index relative to the results of the four individual asset class indexes.