Question 1: Suppose market demand and supply are given by Qd = 100 - 2P and QS = 5 + 3P. The equilibrium quantity is:

1) 92.

2) 81.

3) 45.

4) 62.

Question 2: Having worked for many of the firms in the petroleum industry, you know that the price elasticity of demand for a representative firm is about -1.25. Moreover, a recent report from an economist in your office revealed that the price elasticity of demand for the petroleum products sold by your firm is -1.5. Based on this information, you know that the Rothschild index is:

1) 0.833.

2) 1.20.

3) -1.20.

4) -0.833.

Question 3: An income elasticity less than zero tells us that the good is:

1) a normal good.

2) a Giffen good.

3) an inferior good.

4) an inelastic good.

Question 4: Consider a market characterized by the following demand and supply conditions: PX = 50 - 5QX and PX = 32 + QX. The equilibrium price and quantity are, respectively,

1) $35 and 3 units.

2) $3 and 35 units.

3) $82 and 50 units.

4) $20 and 6 units.

Question 5: If the absolute value of the own price elasticity of demand is greater than 1, then demand is said to be:

1) elastic.

2) inelastic.

3) unitary elastic.

4) neither elastic, inelastic, nor unitary elastic.

Question 6: In the short run, the marginal cost curve crosses the average total cost curve at:

1) a point just below the average fixed cost curve.

2) the minimum point of the average total cost curve.

3) the maximum point of the average total cost curve.

4) the point where the average total cost curve and average variable cost curve intersect.

Question 7: A negative externality:

1) is a payment received to parties not involved in the production or consumption of a good.

2) is a cost borne by parties not involved in the production or consumption of a good.

3) results from the absence of well-defined property rights.

4) is a cost borne by parties not involved in the production or consumption of a good and results from the absence of well-defined property rights.

Question 8: Which of the following pricing strategies is NOT used in markets characterized by intense price competition?

1) Price matching

2) Transfer pricing

3) Randomized pricing

4) Inducing brand loyalty

Question 9: Which of the following statements is NOT true?

1) The Dutch and first-price, sealed-bid auctions are strategically equivalent.

2) A mineral rights auction is a common value auction.

3) An auctioneer is always indifferent between different kinds of auctions.

4) An English auction yields higher expected revenues than a second-price, sealed-bid auction when bidders are risk averse.

Question 10: Rent seeking:

1) involves resources paid to politicians to enhance one group at the expense of another.

2) results in less monopoly power.

3) results in externalities.

4) None of the statements are correct.

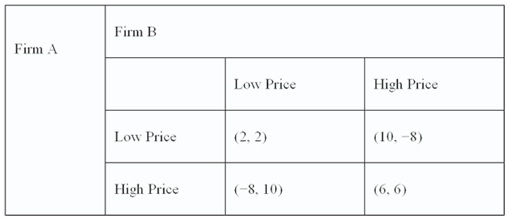

Question 11: The figure below presents information for a one-shot game.

What are dominant strategies for firm A and firm B respectively?

1) (low price, high price)

2) (high price, low price)

3) (high price, high price)

4) (low price, low price)

Question 12: If apples have an own price elasticity of -1.2 we know the demand is:

1) unitary.

2) indeterminate.

3) elastic.

4) inelastic.

Question 13: In the short run, the marginal cost curve crosses the average total cost curve at:

1) a point just below the average fixed cost curve.

2) the minimum point of the average total cost curve.

3) the maximum point of the average total cost curve.

4) the point where the average total cost curve and average variable cost curve intersect.

Question 14: A risk-loving individual would:

1) prefer $5 with certainty to a risky prospect with the expected value of $5.

2) prefer a risky prospect with an expected value of $5 to a certain amount of $5.

3) be indifferent between a risky prospect with an expect value of $5 and a certain amount of $5.

4) prefer a risky prospect with the expected value of $0.50 to $5 with certainty.

Question 15: The manager of a local monopoly estimates that the elasticity of demand for its product is constant and equal to -3. The firm's marginal cost is constant at $20 per unit.

a. Express the firm's marginal revenue as a function of its price.

b. Determine the profit-maximizing price.

Question 16: A risk-neutral consumer is deciding whether to purchase a homogeneous product from one of two firms. One firm produces an unreliable product and the other a reliable product. At the time of the sale, the consumer is unable to distinguish between the two firms' products. From the consumer's perspective, there is an equal chance that a given firm's product is reliable or unreliable. The maximum amount this consumer will pay for an unreliable product is $0, while she will pay $120 for a reliable product.

a. Given this uncertainty, what is the most this consumer will pay to purchase one unit of this product?

b. How much will this consumer be willing to pay for the product if the firm offering the reliable product includes a warranty that will protect the consumer?

Question 17: Suppose the own price elasticity of market demand for retail gasoline is -0.9, the Rothschild index is 0.6, and a typical gasoline retailer enjoys sales of $1,200,000 annually. What is the price elasticity of demand for a representative gasoline retailer's product?