Use the IS/LM Model to answer the following set of questions. You are given the following information about a closed economy. Assume that net taxes and government spending are both constant and exogenously given to you.

|

Real GDP

|

Net Taxes

|

Government Spending

|

Investment Spending

|

Consumption Spending

|

Private Saving

|

|

1000

|

100

|

200

|

25

|

|

125

|

|

2000

|

100

|

200

|

275

|

|

375

|

|

3000

|

100

|

200

|

525

|

|

625

|

In addition, you are told that the following information:

Money Supply = M = 600

Aggregate Price Level = P = 1

Money Demand = 600 + .5Y - 312.5r

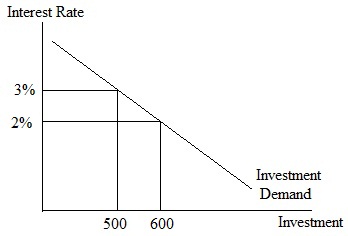

Investment Demand = I = I(r) = when investment is equal to 600 the interest rate is 2% and for each percentage increase in the interest rate, investment decreases by 100 (the investment demand equation is linear with respect to the interest rate) [Hint: in writing the investment demand equation the interest rate is entered as a whole number and not a percentage. For example, if the interest rate is 2%, then in the equation r would have a value equal to "2".]

Question 1. Fill in the missing column labeled "Consumption Spending" in the above table.

Question 2. The MPC is constant in this economy as is autonomous consumption. Derive the consumption function equation with respect to disposable income (Y - T) for this economy based on all the information you have been given.

Question 3. Derive an equation for the investment demand function for this economy where investment is expressed as a function of the interest rate r. Write your equation in the form I = I (r). Base your equation on all the information you have been given. Hint: read over the above information about the investment demand carefully!

Question 4. Derive the IS equation for this economy.

Question 5. Derive the LM equation for this economy.

Question 6. What is the equilibrium value of real GDP and the interest rate for this economy?

Question 7. Suppose the interest rate is equal to 6% and the level of real GDP is equal to 3750 in this economy. Given these values describe the loanable funds market, the goods market and the market for real money balances. I.e., are these markets in equilibrium, or is there excess demand, or excess supply? Be specific in your answer.

a) Loanable funds market

b) Goods market

c) Market for real money balances

Question 8. Suppose the interest rate is equal to 4% and the level of real GDP is equal to 3300 in this economy. Given these values describe the loanable funds market, the goods market and the market for real money balances. I.e., are these markets in equilibrium, or is there excess demand, or excess supply? Be specific in your answer

a) Loanable funds market:

b) Goods market:

c) Market for real money balances

Question 9. In this economy suppose that government spending is increased by 1025 so that the total amount of government spending in this economy is now 1225. What is the change in real GDP (Y) predicted by the Keynesian Cross diagram?

Question 10. What is the actual change in real GDP (ΔY) given the change in government spending described in (9) using the IS/LM model?