Covered Interest Arbitrage

Response to the following problem:

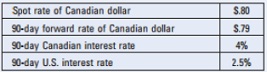

Assume the following information:

Given this information, what would be the yield (percentage return) to a U.S. investor who used covered interest arbitrage? (Assume the investor invests $1 million.) What market forces would occur to eliminate any further possibilities of covered interest arbitrage?