Notice: Do not use excel, use ONLY financial Calculator:

Question 1:

a) Wildcat Company stock is trading for $80 per share. The stock is expected to have a year end dividend of $4 per share (D1 = $4) which is expected to grow at some constant rate g through tome. The stock 's required rate of return is 14%. If you are an analyst who believes in efficient markets, what is your forecast of g?

b) You are considering an investment in the Tiger Corporation. The stock is expected to pay a dividend of $ 2 at the end of the year (D1 = S2). The stock has a beta coefficient of 9. The risk free rate is 5.6%, and the market risk premium is 6%. The stock's dividend is expected to grow at some constant rate g. The stock currently sells for $25 per share. assuming the market is in equilibrium, what does the market believe the stock price will be in three years (That is, what is P3)?

Question 2: The Gator Company has an outstanding bond issue that will mature to its $1000 par value in ten years. The bond has a coupon interest rate of 12 percent and pays interest annually.

a) Find the value of the bond if the required return is (1) 12%, (2) 14%, and (3) 10%, with 10 years to maturity.

b) Find the value of the bond if the required return is (1) 12%, (2) 14%, and (3) 10%, with 3 years to maturity.

c) Plots your finding in (a) and (b) on a diagram with time to maturity on the (x-axis) and the market value of the bond on the (y-axis).

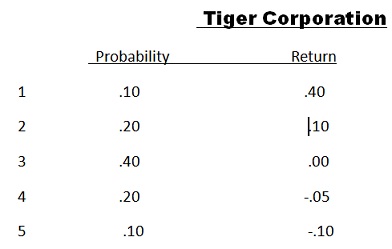

Question 3: An investment is being considered by the Tiger Corp. The following probability distribution of expected returns for this asset has been developed (Show all your Work).

Question 4: Market interest rates may rise by two percent in the near future. Compute Maculays duration, Modified duration, and potential the change to price, of the $1000 Fernando-Cara Company bond that has 3 years to maturity, and a ten percent coupon. The present market rate of interest on bonds of similar risk is seven percent. You may assume the convexity factor(C) is 250. (Show all your work).

Question 5:

a) Illustrate graphically, and explain clearly the two types of risks in a portfolio, which is the relevent and why?

b) Illustrate graphically, and clearly explain the Security Market Line(SML), and the risk premiums of (i) a market portfolio with a return 10 percent, and (ii) a security with a beta coefficient of 1.5 and an expected return of 15 percent. Assume the risk-free ate is 5 percent.

c) Illustrate graphically and clearly explain the concept of ACMe Companys characteristic Line. What does the Characteristic Line show? Who originated it and Why?