Assignment:

PART A

1. Suppose you wish to accumulate $10,000 in a savings account 4 years from now, and the account pays you an interest rate of 5% per year, how much money must be deposited today?

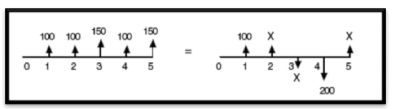

2. What value of X makes these two cash flows equivalent assuming an interest rate of 10%?

3. The operating cost of a small machine is $800 in year one, $900 in year two, $1000 in year three, increasing by $100 per year through year ten. At an interest rate of 8% per year, determine the equivalent annual worth of the machine.

4. What is the future worth of an equal quarterly payment series of $2,500 for 10 years, if the interest rate is 9%, compounded monthly?

5. What is the capitalized cost of $10,000 for every 5 years forever, starting now at an interest rate of 10% per year.

6. Consider a project with a first cost (investment) of $250,000, an annual O&M cost of $50,000, annual revenue of $160,000, and a salvage value of $40,000 after a 10-year life. Find the annual worth of the project assuming an interest of 13% per year.

7. A permanent scholarship fund is started through a donation of $100,000. If five scholarships of $5,000 each are awarded each year beginning ten years from now, what is the rate of return ‘i' for the invested money?

8. If a company invests $10,000 and receives $2,775 per year for five years, what is the rate of return on the investment?

PART B

1. A small manufacturing company is considering purchasing a maintenance contract for its air conditioning systems. Since all of its systems are new, the company plans to begin the contract at the end of year four and continue through year ten. The cost of the contract is $3,200 per year and the company's minimum attractive rate of return is 12% per year.

a. Draw the cash flow diagram

b. What will the present worth of the contract be?

c. What will be the future worth of the contract?

d. If the company wishes to pre-pay the contract with uniform payments in years one, two and three only, what will be the amount of each payment?

2. National Homebuilders, Inc., plans to purchase new cut and finish equipment. Two manufacturers offered the estimates shown below:

1. Draw the cash flow diagram for both vendors.

2. Determine which vendor would be selected based on PW if the MARR is 15% per year

|

|

Vendor A

|

Vendor B

|

|

First Cost, $

|

-15,000

|

-18,000

|

|

Annual Operating costs (AOC), $/year

|

-3,500

|

-3,100

|

|

Salvage Values S, $

|

1,000

|

2,000

|

|

Life, years

|

6

|

9

|

PART C

1. Compare and pick the best the cost alternatives based on incremental ROR analysis for a MARR of 15%. All alternatives have the same lives with no salvage value

|

Alternative

|

Investment

|

Operating Cost

|

|

A

|

$5000

|

$240

|

|

B

|

$3000

|

$875

|

|

C

|

$4000

|

$500

|

|

D

|

$2500

|

$1000

|

2. Two stamping machines are under consideration for purchase by a metal recycling company. The manual model will cost $25,000 to buy with an eight-year life and a $5,000 salvage value. Its annual operating costs will be $16,000. A computer-controlled model will cost $95,000 to buy and it will have a twelve-year life if upgraded at the end of year six for $15,000. Its terminal salvage value will be $23,000, with annual operating costs of $7,500 for labor and $2,500 for maintenance. The company's minimum attractive rate of return is 18%.

a. Draw the cash flow diagram for both machines.

b. What is the annual worth of the computer-controlled machine?

c. What is the equivalent annual worth of the manual model?

d. Determine the capital recovery costs for the manual model?