Answer the following questions.

Question 1) Explain in detail the decisions that financial manager has to take regarding the financial matters of a corporation.

Question 2)(a) Sam is looking into the investment that will pay him Rs.10,000 per year for the next 5 years. If he needs a 10 percent return, what is the most he would pay for this investment?

(b) ABC Corp. bond carries 6 percent coupon paid semi-annually. The par value is Rs.1, 000 and the bond mature in five years. If the bond currently sells for Rs.912, what is the yield to maturity?

Question 3) Write a detail note on functioning of efficient financial markets.

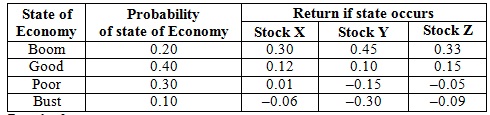

Question 4) Consider the following information:

Required:

(a) Compute the expected return and standard deviation of each stock.

(b) Assume the portfolio is invested 30 percent each in Stock X and Stock Z, and 40 percent in Stock Y, what is the expected return of the portfolio?

Question 5)(a) What do you understand by NPV and IRR? Give your answer with the help of illustration.

(b) What is the difference between cash dividend and stock dividend? Explain.