Assignment:

Demand equation

Question#1

Demand equation. Helen's Health Foods usually sells 400 cans of ProPac Muscle Punch per week when the price is $5 per can. After experimenting with prices for some time, Helen has determined that the weekly demand can be found by using the equation d= 600 - 40p,

where d is the number of cans and p is the price per can.

a) Will Helen sell more or less Muscle Punch if she raises her price from $5?

b) What happens to her sales every time she raises her price by $1?

c) Graph the equation.

d) What is the maximum price that she can charge and still sell at least one can?

Question#2

Age at first marriage. The median age at first marriage for females increased from 24.5 years in 1995 to 25.1 years in 2000 (U.S. Census Bureau, www.census.gov). Let 1995 be year 5 and 2000 be year 10.

a) Find the equation of the line through (5, 24.5) and (10, 25.1).

b) What do x and y represent in your equation?

c) Interpret the slope of this line.

d) In what year will the median age be 30?

e) Graph the equation.

Question#3

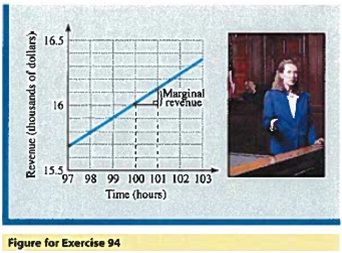

Marginal revenue. A defense attorney charges her client $4000 plus $120 per hour. The formula R = 120n + 4000 gives her revenue in dollars for n hours of work. What is her revenue for 100 hours of work? What is her revenue for 101 hours of work? By how much did the one extra hour of work increase the revenue? (The increase in revenue is called the marginal revenue for the 101st hour

Question#4

Set up a system of linear equations to describe the following problem and solve the system using one of the methods discussed this week.

At the end of the year, a business has made a profit of $158,000. They must calculate the amount of tax due to the federal government and to the state. The federal tax rate is 30%, and the state tax rate is 10%. State taxes (ST) are deductible before federal taxes (FT) are calculated, and federal tax are deductible before states taxes are calculated. In other words, state taxes are subtracted from the profits before the 30% federal tax is calculated, and federal taxes are subtracted from the profits before the 10% state tax is calculated. 10% or 30 % of 158,000 does not require a system of equations to solve. Do not begin in this manner. Create and solve a system of equations to figure out how much state and federal taxes are owed by this company $158,000 For example; #6 will be calculating the result based on $156,000 profit.

1. Identify the variables first. Do not confuse the tax rate with the amount of tax.

2. Set up a system of two equations. This is the only way that this problem can be solved.

3. Solve the system. Remember to report the answer in dollars.

Question#5

Using the addition (elimination) method to solve systems of equations.

8x -4y = 11

2x+3y = -4

Question#6

Solve using substitution.

Equations; y=-x/2+2 and y = 3x/8+7