Question 1: A start-up company selling color-keyed carnauba car wax borrows $40,000 at an interest rate of 10% per year and wishes to repay the loan over a 5-year period with annual payments such that the third through fifth payments are $2000 greater than the first two. Determine the size of the first two payments.

Question 2: How much money would you have pay each year in 8 equal payments, starting 2 years from today, to repay a $20,000 loan received from a relative today, if the interest rate 8% per year?

Question 3: The operating cost of a pulverized coal cyclone furnace is expected to be $80,000 per year. If the steam produced will be needed only for 5 years beginning now (i.e., years 0 through 5), what is the equivalent annual worth in years 1 through 5 of the operating cost at an interest rate of 10% per year?

Question 4: The first phase will reduce labor and travel costs by $28,000 per year. The second phase will reduce costs by an additional $20,000 per year. If phase I savings occur in years 0, 1, 2 and 3 and phase II occurs in years 4 through 10, what is the equivalent annual worth of the upgraded system in years 1 through 10 at an interest rate of 8% per year?

Question 5: Calculate the future worth (in year 11) of the following income and expenses, if the interest rate is 8% per year.

YEAR INCOME EXPENSE

0 12,000 3000

1-6 800 200

7-11 900 200

Question 6: Operating cost per machine is $22,000 per year for years 1 and 2 and then it increases by $1000 per year through year 5, what is the equivalent uniform annual cost per machine (years 1 through 5) at an interest rate of 12% per year?

Question 7: Calculate the present worth (year 0) of a lease that requires a payment of $20,000 now and amounts increasing by 5% per year through year 10. Use an interest rate of 14% per year.

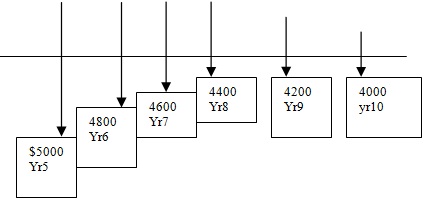

Question 8: Compute the future worth in year 10 at i=10% per year for the cash flow shown below.