Problem:

Recall that the correlation coefficient is a single value that captures the direction and extent of linear association between 2 random variables (securities). The formula for measuring covariance is equal to the correlation coefficient (rho) multiplied by the standard deviation for security1 multiplied by the standard deviation of security2.

Cov(rGM, rS&P500) = ρGM,S&P500 σGM σS&P500

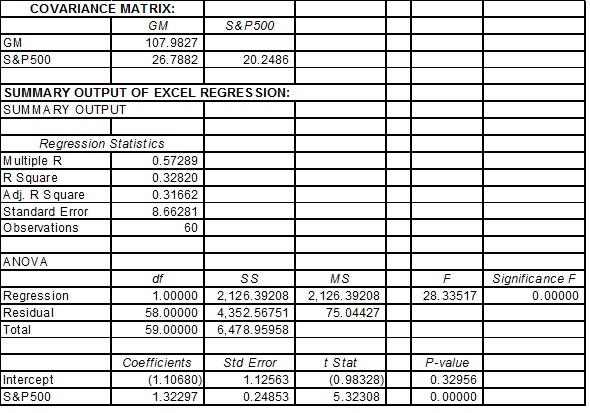

Based on the Summary Output of Excel Regression (aka Analysis of Variance (ANOVA)) output listed below answer the following questions:

A) Determine the Correlation of Determination (r squared):

B) Determine the Correlation coefficient “r” (rho symbol = ):

C) Determine (calculate) the Covariance (formula given above) between GM and S&P500. Note: the Covariance of an asset with itself is equal to its Variance. The standard deviation (sigma symbol = ) is equal to the square root of the variance.