Assignment:

Currency depreciation affects wealth and output across countries

When the currency of a country, say the US, depreciates due to demand and supply or the government devalues it, the export prices will fall. This, in turn, causes an increase in quantity demanded in the country's goods.

In contrast, depreciation of the US dollar increases the price of imports from foreign countries. Due to the higher prices of imports, the US will be forced to reduce its amount of imports and try to substitute the imports with its locally produced goods. Hence, depreciation increases exports and decreases imports; the net aggregate demand for local goods increase.

If the output level lowers because of demand recession, the rise of aggregate demand or increased expenditure on domestic output, the out expands and leads to an increase in GNP.

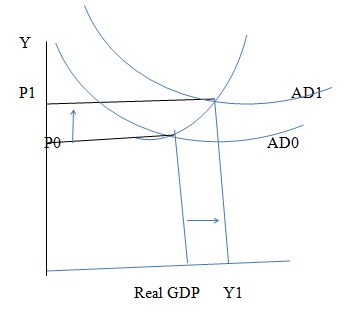

Figure 1: Depreciation causes a rise in net exports that in turn increases the GDP

Though, if a country decides to devalue its currency so as to stimulate the economy, other countries may do the same. If all countries devalue their currencies, no gain in real income will be attained. Many countries devalue their currencies to maintain their exports to protect their income level. Through this, they can compete with other countries.

Maintaining a flexible vs. floating exchange rate regime depends on the wealth position of a country

To operate a flexible exchange rate regime, there needs to be a foreign exchange market which is liquid and can allow the exchange rate to change according to the market forces. To manage the exchange rate regime, a country should check on its balance of payments position, developments of parallel markets and the level of international reserves.

For many developing countries, their foreign exchange markets are shallow and inefficient. They experience a lot of foreign exchange regulations like cross-border controls, need to surrender foreign exchange receipts and the tight limits on the open foreign exchange positions. The regime affects a country's short run reaction to shocks and the regime may permanently affect a country's structure.

The position of a country that determines its choice of exchange rate regime can be termed as the effectiveness score. This is measured by the State Fragility Index (SFI). It measures the country’s regime durability, economic and social effectiveness.

The measurements are interpreted using the values from 0 to 9; 0 shows the maximum effectiveness and the effectiveness reduces are the number gets larger.

A country that reflects a low effectiveness score need to give up its sovereignty for the exchange rate. The country is also not able to keep a flexible exchange rate since it is likely to incur the risk of great fluctuations. It will also not be able to develop a credible inflation that targets the regime.

On the other hand, a country with a credible central bank, the costs of giving up its monetary policy will be high that the benefits of being part of a credible monetary union.

The country’s position ontrade is also critical in deciding on the exchange rate regime. The optimal currency theory states that a country that is more open to international trade will be more affected by the volatility of exchange rate and will need to adopt a fixed rate. The openness of a country is calculated by adding up its imports and exports then diving by the GDP.

Question:

What determines the rate of depreciation in the short-run and long-term? Use both the CPI /UPI and the relative PPP How does a change in the CA belance as a result of depreciation affect the external wealth?

References:

Miles, M. A. (1979). The effects of devaluation on the trade balance and the balance of payments: some new results. The Journal of Political Economy, 600-620.

Chang, R., & Velasco, A. (2000). Financial fragility and the exchange rate regime. Journal of economic theory, 92(1), 1-34.

Baxter, M., & Stockman, A. C. (1989). Business cycles and the exchange-rate regime: some international evidence. Journal of Monetary Economics, 23(3), 377-400.