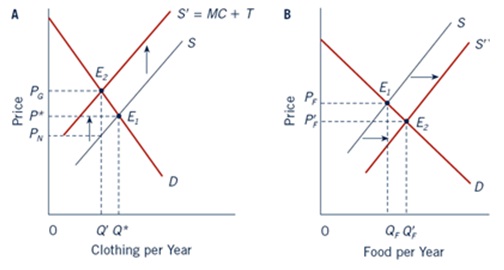

Problem: The given figure shows that a tax on clothing can reduce the price of food. Suppose that after the tax on clothing consumption is imposed, another tax is levied on the consumption of food. For example, the consumption of both commodities would be subject to a tax of five percent. Describe the conclusions of your analysis assuming the same tax is present in both the clothing and the food markets. Further assume that the tax revenue is returned in equal lump-sum transfers to all citizens.