Question1:

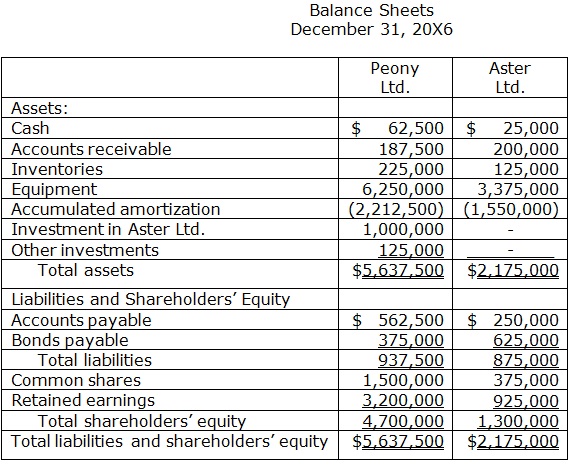

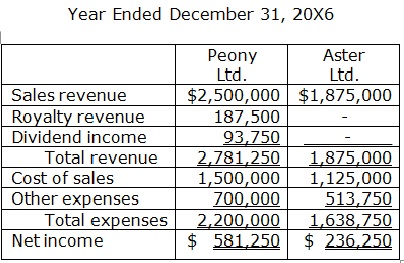

Income Statements

Statements of Retained Earnings

• At January 1, 20X1, Peony Ltd. acquired 80% of the common shares of Aster Ltd. by issuing 500,000 Peony common shares valued at $2 per share. This resulted in Peony having 1,500,000 issued and outstanding shares.

• Peony has provided the following information about Aster at the acquisition date:

Aster’s shareholders’ equity consisted of the following:

Common shares $375,000

Retained earnings 693,750

Fair value of Aster’s net identifiable assets equalled their carrying value, with the exception of the following items:

Excess of fair value

over carrying value:

Inventories $ 12,500

Equipment 93,750

Investments 12,500

The accumulated amortization on the equipment was $718,750. The equipment is amortized on a straight-line basis. At the acquisition date, the equipment is estimated to have a remaining life of 10 years with no residual value.

• In 20X3, Aster sold its investments to parties outside the consolidated entity for $56,250 over carrying value.

• From the acquisition date to December 31, 20X5, Aster paid royalties of $625,000 to Peony. During 20X6, Aster paid $112,500 in royalties to Peony.

• At the beginning of 20X4, Peony purchased some equipment from Aster for $113,750. Aster had originally acquired the equipment for $125,000 and was amortizing it at a rate of $12,500 per year. When Aster sold the equipment to Peony, it had a carrying value of $87,500. At that time, Peony estimated that the equipment had a remaining life of 7 years and started amortizing the equipment in 20X4, using the straight-line method with no residual value.

• At December 31, 20X5, Aster’s inventory included $25,000 of goods purchased from Peony. Peony’s gross margin on the sale was 40%. The goods were sold to third parties in 20X6.

• At December 31, 20X5, Peony’s inventory included $125,000 of goods purchased from Aster. Aster’s gross margin on the sale was 40%. The goods were sold to third parties in 20X6.

• During 20X6, Peony sold goods to Aster for $125,000. Peony’s gross margin on the sale was 40%. At December 31, 20X6, $50,000 of the goods are still in Aster’s inventory.

• During 20X6, Aster sold goods to Peony for $875,000. Aster’s gross margin on the sale was 40%. At December 31, 20X6, $87,500 of the goods are still in Peony’s inventory.

• Peony uses the entity method to report business combinations.

Required:

Prepare the consolidated financial statements for Peony at December 31, 20X6 using the direct method. Show all your work.

Question2:

On January 1, 20X4, Chee Co. purchased 80% of the outstanding shares of Tyme Ltd. for $2,000,000 in cash. On the acquisition date, Tyme’s shareholders’ equity consisted of the following:

Common shares $1,600,000

Retained earnings 800,000

At the time of acquisition, the carrying values of Tyme’s identifiable net assets equalled their fair market values with the following exceptions:

• The fair value of a building with an estimated remaining life of 10 years was $480,000 less than its carrying value.

• A long-term liability that matures in 8 years has a fair value that is $400,000 less than its carrying value.

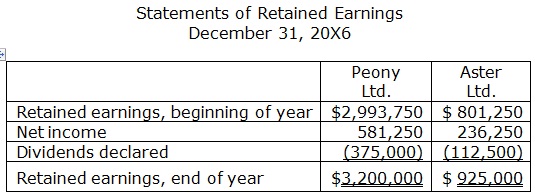

The condensed income statements for Chee and Tyme are presented below:

Income Statements

Additional information:

• At the beginning of 20X5, Chee acquired a piece of equipment from Tyme for $168,000. Tyme had purchased the equipment 5 years ago for $320,000. When Tyme purchased the equipment, it had expected that it would have a useful life of 20 years, with no residual value. Chee concurred with this estimate (i.e., at the time of purchase, Chee expected that the equipment would have a remaining useful life of 15 years). Both Tyme and Chee use the straight-line method of amortization.

• Sale of goods from Chee to Tyme:

Gross Unsold Goods in Tyme’s

Year Sales Margin Inventory at Year-End

20X7 $400,000 30% $80,000

20X8 320,000 30% 72,000

• Sale of goods from Tyme to Chee:

Gross Unsold Goods in Chee’s

Year Sales Margin Inventory at Year-End

20X7 $240,000 40% $56,000

20X8 200,000 40% 48,000

• All goods in inventory at year-end were sold to third parties in the subsequent year.

• On August 31, 20X8, Chee purchased a tract of land from Tyme for $106,400 in cash. Tyme had acquired the land 12 years previously for $52,000.

• During 20X8, Chee declared and paid dividends of $200,000 and Tyme declared and paid dividends of $32,000.

• There was no impairment of goodwill at the end of 20X8.

• Chee accounts for its investments using the cost method and uses the entity theory method to report its business combinations.

Required:

a) Prepare a consolidated income statement for Chee Co. for the year ended December 31, 20X8. Be sure to show your supporting calculations.

b) Prove that your calculation of net income attributable to the shareholders of Chee Co. in (a) is correct by calculating Chee’s net income using the equity method.

Question3:

At the beginning of 20X3, Jong Ltd. acquired 80% of the outstanding shares of Nye Co. for $1,400,000. At the acquisition date, Nye’s shareholders’ equity consisted of the following:

Common shares $350,000

Retained earnings 875,000

At the time of acquisition, all of Nye’s net identifiable assets had carrying values that equalled their fair values with the exception of its patents. The fair value of the patents exceeded their carrying values by $525,000 and had a remaining life of 8 years.

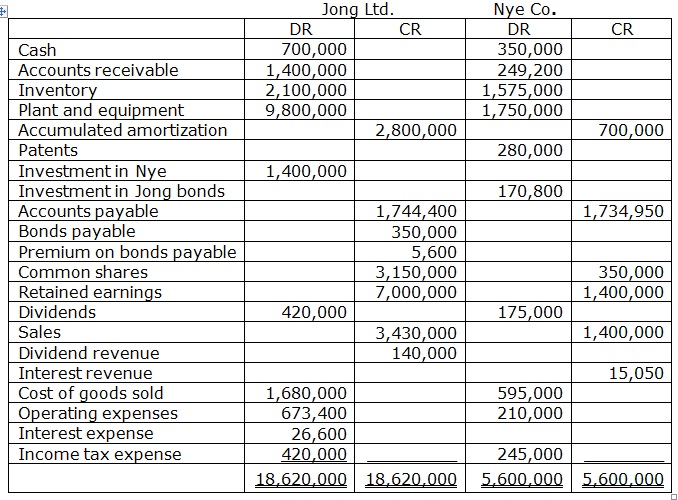

The trial balances for Jong and Nye for December 31, 20X6 are as follows:

Additional information:

• 20X6 net income for Jong is $770,000 and for Nye, $365,050.

• At the beginning of 20X6, Jong purchased a piece of equipment from Nye for $350,000. At the time of purchase, the equipment had a net book value of $280,000 to Nye and an estimated useful life of 5 years.

• At the end of 20X5, Jong’s inventory included $350,000 of goods purchased from Nye. Nye’s had recorded a gross profit of $140,000 on this sale.

• During 20X6, Nye sold goods to Jong for $700,000. Nye earned a gross profit of $280,000 on this sale.

• At the end of 20X6, Jong had sold all the goods in its opening inventory to third parties but still had $210,000 of the goods purchased from Nye during 20X6 in its ending inventory. All of those goods will be sold to third parties in 20X7.

• Amortization expense for the plant, equipment, and patent are included in operating expenses.

• At the beginning of 20X4, Jong issued bonds for $359,800. These bonds have an interest rate of 8%, mature in 7 years, and have a face value of $350,000. Interest will be paid annually at the end of the year. Nye purchased half of these bonds at the beginning of 20X6 for $169,750. Any intercompany gains or losses on these bonds are to be allocated between the two companies.

• Both companies have an average income tax rate of 40%.

Required:

Assume that Jong used the equity method of accounting for its investment in Nye instead of the cost method. Calculate the balance of its “Investment in Nye” account.