Problem:

On 30 September 2005 Gold Plc obtained 75% of common shares, 30% of the preferred shares and 20% of bonds in Silver plc and gained control. The balance of retained earnings on 30 September 20X0 was Rs16, 000. The fair value of land owned by Silver was Rs 3,000 above book value. No adjustment has so far been made for this revaluation.

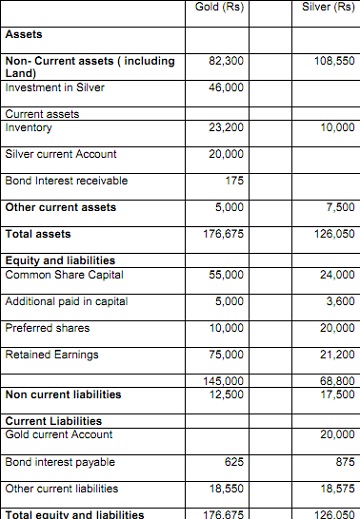

The balance sheets of Silver and Gold at 31 December 2006 together with group accounts were as follows:

Additional information:

• 20 % of goodwill is to be written off as impairment loss

• Throughout the year Gold sold some of its inventory to Silver for Rs 3,000 which represented cost plus a mark-up of 25 %. Half of these goods are still in inventory of Silver at 31 December 2006

• There is no depreciation of land

• There has no movement on share Capital or additional paid up capital since acquisition.

Required:

Make consolidated balance sheet as at 31 December 2006