Case scenario:

The board of directors of Trinity Hospital is working on a five-year strategic plan for the facility. One of the strategic goals is to build a new $1 million cancer research wing in five years. The group is concerned that current economic conditions might reduce revenues over the next five years and they are uncertain about the fate of the construction project. You are part of team tasked with conducting a capital budgeting analysis. The cost of capital is 10%.

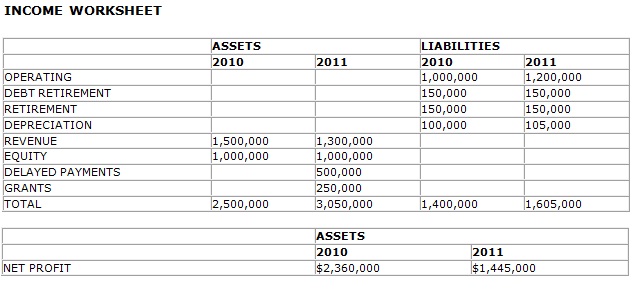

Trinity Hospital reported 1.5 million in revenue in 2010 and 1.3 million in 2011. The hospital’s equity is $2 million. The hospital estimates delayed third-party payments in 2011 of $500 thousand. The hospital expects to receive $250 thousand in grants in 2011.

The hospital has current liabilities include operating costs of $1 million in 2010 and $1.2 million in 2011. In addition, the hospital retired $150 thousand of debt in 2010 and 2011. The hospital funded the employee pension plan with matching funds of $150 thousand in both 2010 and 2011. Malpractice costs were $150 thousand in 2010 and 2011. Depreciation expenses of $100 thousand in 2010 and $105 thousand in 2011. The hospital is a nonprofit facility so firm incurs no tax liabilities.

Tasks:

Nonprofit organizations are limited in the methods they can employ in raising capital. For example, nonprofits cannot issue stock. However, nonprofit hospitals can issue bonds as a method for raising capital.

• Determine if bonds offer investors an advantage over investments with the risk-free return of 5% and the bonds are held to their maturity date if;

Bond price - $500

Bond par price (face value) - $1000

Bond coupon rate – 2%

Years to Maturity – 10