QUESTION 1

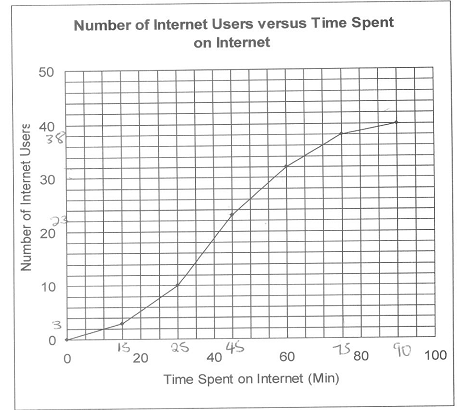

The following graph, drawn to scale, represents the grouped frequency distribution of the time spent on the Internet by a randomly-selected sample of Internet subscribers during their most recent session.

1.1 Construct a less-than-cumulative frequency distribution of the data represented by the graph.

1.2 Use the information obtained in 1.1 above to calculate each of the following quantities.

1.2.1 mode

1.2.2 mid 65% range

1.2.3 standard deviation

QUESTION 2

The probability that a call-centre consultant receives 3 calls during any given hour is 0.1404 and the probability that the consultant receives 5 calls during any given hour is 0.1755. Assuming that the calls are Poisson-distributed, calculate the probability that the consultant receives at least 2 calls during any 30 minute period.

QUESTION 3

A bank with a branch located in the commercial district of a city has developed an improved process for serving customers during the 12:00 to 13:00 peak lunch period. The waiting times, during this period, of all customers was recorded over a period of one week. The waiting times (in min) of 15 randomly-selected customers is given below.

|

4.21

|

5.55

|

3.02

|

5.13

|

4.77

|

|

2.34

|

3.54

|

3.20

|

4.50

|

6.10

|

|

0.38

|

5.12

|

6.46

|

6.19

|

3.79

|

Suppose that another bank located in a residential area is most concerned with the Friday evening hours from 5 to 7. A sample of the waiting times of 15 randomly-selected customers is given in the table below.

|

9.66

|

5.90

|

8.02

|

5.79

|

3.82

|

|

8.01

|

8.35

|

10.49

|

6.68

|

5.64

|

|

4.08

|

6.17

|

9.91

|

5.47

|

8.73

|

Conduct a full test, at the 5% level of significance, to establish whether there is a statistically significant difference between the population mean times in the two banks. (Assume that the samples are drawn from populations that are approximately normally distributed and that their variances are equal.)

QUESTION 4

The managers of a retail giant are preparing revenue plans for the period from October 2013 to March 2014. The data given below represents the amounts (in $m) of one of their main products.

|

|

Apr-Jun

|

Jul-Sep

|

Oct-Dec

|

Jan-Mar

|

|

2009/10

|

49

|

37

|

58

|

67

|

|

2010/11

|

50

|

38

|

59

|

68

|

|

2011/12

|

51

|

40

|

60

|

70

|

|

2012/13

|

50

|

42

|

-

|

-

|

Use the moving-average method to make seasonally-adjusted trend estimates for the third and fourth quarters of 2013 and the first two quarters of 2014. Assume that the cyclical and irregular forces have minimal influence on the time series. (Show details of all your calculations.)

QUESTION 5

A company with an ageing product range is investigating the launch of a new range. Its business analysts have mapped out the following scenarios.

Scenario 1

Continue with the old range with profits declining at 10% per annum on a compounding basis. Profits from this range for the previous year totaled $60000.

Scenario 2

Introduce a new range without any prior market research. If sales are high, annual profit is put at $90000 with a probability of 0.7. If sales are low, annual profit is put at $30000, with a probability of 0.3.

Scenario 3

Introduce a new range with prior market research costing $30000. The market research will indicate whether future sales are likely to be "good" or "bad". If the research indicates "good", then the management will spend $35000 more on capital equipment and this will increase the annual profit to $1000000, provided sales are actually high. However, if sales are actually low, the annual profit will drop to $25000. Should management decide not to spend more on promotion (given a good research report), then profit levels will be as for scenario 2. If the research indicates "bad", then management will scale down their expectations for an annual profit of $70000.

Probability calculations reveal the following information.

The probability of a favourable research report = 0.59.

The probability of high sales given a favourable research report = 0.95.

The probability of high sales given an unfavourable research report = 0.34.

With the aid of a decision tree prepare a quantitative report advising the company on the optimal course of action.

(Use a time horizon of 6 years and ignore the time value of money.)