Case 1:

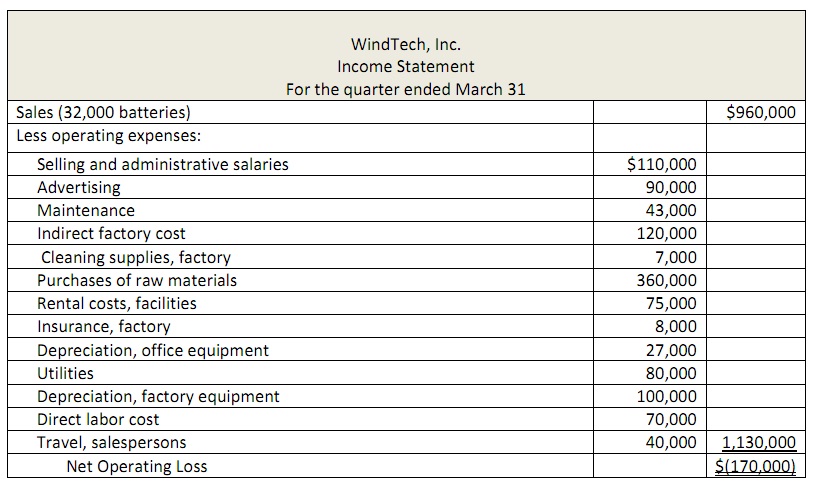

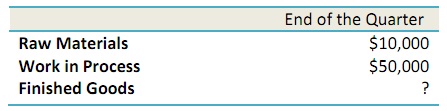

Roger Powers, founder and president of WindTech, Inc. was dismayed when presented with the following report. Despite better-than-expected sales the first quarter, the company’s ability to remain a going concern was now in doubt based on the high cost of operations. His company was organized at the beginning of the current year to produce and market a revolutionary new storage battery that captures and stores electricity generated by wind power. In addition, on April 3, the company’s finished goods warehouse was destroyed by a fire and all 8,000 unsold batteries were destroyed. These batteries represented 20% of the first quarter’s production. Although the company’s insurance policy states that the company will be reimbursed for the ‘cost‘of any finished batteries destroyed or stolen, the insurance adjuster is disputing the company’s claim of $226,000. The company’s somewhat inexperienced accountant determined the amount of the claim as follows:

Total Costs for the quarter/Batteries produced during the quarter = $1,130,000/40,000 units = $28.25/unit

$28.25 x 8,000 batteries = $226,000

The following additional information concerning the company’s activities during the quarter is available:

Eighty percent of the rental cost for facilities and 90% of the utilities cost relate to manufacturing operations. The remaining amounts relate to selling and administrative activities.

a) Describe the conceptual errors, if any, made in preparing the income statement above.

b) Prepare a schedule of cost of goods manufactured for the first quarter.

c) Prepare a corrected income statement for the first quarter. Show how cost of goods sold is computed.

d) Do you agree that the insurance company owes WindTech $226,000? Explain your answer.

Case 2: Activity Based Costing (ABC) and Activity Based Management (4- 5 double spaced pages)

Developed in the mid-1980, ABC continues to help companies create value through improved profitability by overcoming distortions inherent in cost accounting systems. Though initially adopted primarily by manufacturers, ABC has moved into many diverse industries, the government, and military. Perform an internet search to answer the following questions related to the current use of ABC:

a) Describe the evolution of ABC over time. As ABC moves to the maturity phase of its life cycle, what other uses for ABC (besides cost accounting) have been developed? What impact has recent advances in technology had on ABC?

b) There are numerous examples of successful ABC applications that can be found on the internet. Find case studies for two organizations, preferably one business and one nonprofit/government/military organization. (Many software companies with ABC applications will post their client’s success stories on their website in order to attract new clients). Summarize the following information from the two cases:

- What reasons were given for implementing ABC?

- What benefits were achieved by each organization?

- What problems were mentioned, if any?

c) In general, what are some downsides, if any, of adopting ABC?