Question 1: The demand curve for oranges is given by the equation P = 5 – Q/200. The supply curve is given by P = Q/800. Q is measured in oranges per day and price is measured in dollars per orange. Suppose the government imposes a tax $0.15 on the sellers of oranges and a tax of $0.35 on consumers simultaneously.

(i) Graph the demand and supply curves (including intercepts!)

(ii) Compute the equilibrium price and quantity before the taxes are imposed.

(iii) Compute the post-tax equilibrium price and quantity.

(iv) What price is received by sellers and price paid by consumers after the taxes are imposed.

(v) Compute the tax revenue collected by the government.

Question 2: Assuming the Heckscher–Ohlin model is true. Suppose the Cuba and Russia sign a free trade agreement. Furthermore, assume the Cuba and Russia only produce cigars and vodka. Russia has comparative advantage in producing vodka (a K intensive good) and Japan has comparative advantage in producing cigars (a L intensive good). Using supply/demand curves and PPFs to show the following :

(i) Draw both countries PPFs on the same graph and show what happens to quantity of cigars and vodka each country chooses to produce before and after trade. Label your graph fully (that is, identify each country’s ppf, autarky points on ppf, post-trade points on ppf, gains from trade)

(ii) Using supply/demand graphs show the effects on factor prices after the Free Trade agreement is signed.

(iii) Explain why a country with comparative advantage in the labor intensive good may choose to completely exploit their comparative advantage in that good.

Question 3: Suppose the Danny can prepare 50 pizzas or 100 sandwiches in an hour and Steve can produce 15 pizzas or 9 sandwiches.

(i) Draw each individual’s PPF.

(ii) Calculate the opportunity costs for each individual for each good.

(iii) Who has absolute and comparative advantage in each good.

Question 4:

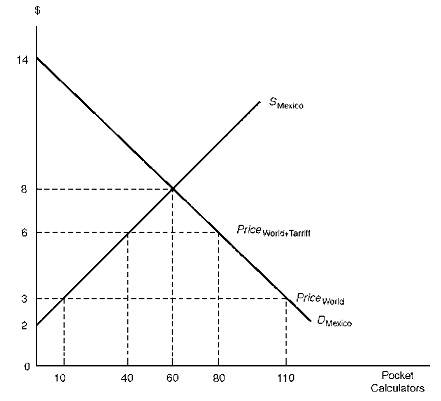

(i) Calculate Mexico's producer surplus and consumer surplus in autarky.

(ii) Calculate the number of Mexican imports with as well as without the Tarriff.

(iii) Calculate Mexico's producer surplus and consumer surplus with free trade but without the tariff.

(iv) Calculate the dead weight loss of the tariff.

Question 5:

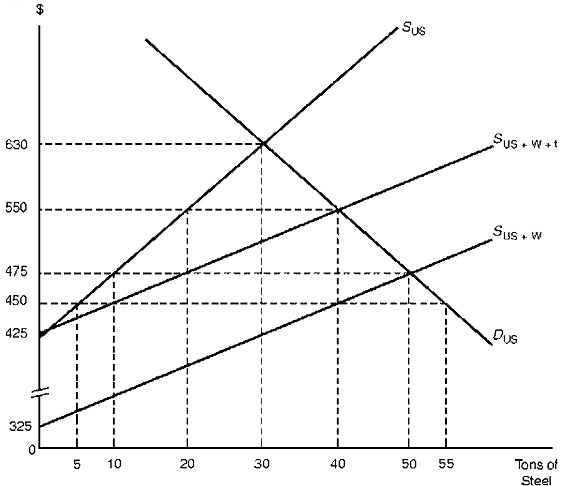

(i) Calculate the number of US imports with and without the tariff.

(ii) Calculate the dead weight loss of the tariff.

(iii) Calculate the loss in consumer surplus resulting from the tariff.

(iv) Calculate the “terms of trade” effect of the tariff. Should the US implement this policy.