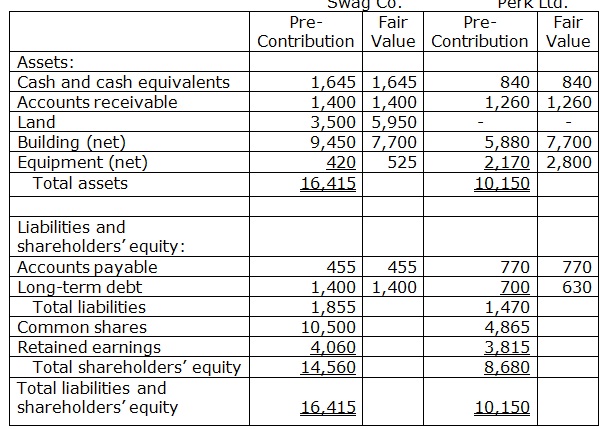

Problem 1

Pre-Contribution Balance Sheets and Fair Values

June 30, 20X9

(in thousands of $)

Swag Co. gets Perk on June 30, 20X9. Both the companies have June 30 year-ends. Before the combination, Swag and Perk had, respectively, 840,000 and 525,000 common shares, issued and outstanding.

Required:

Make Swag’s consolidated balance sheet under each of the following situations independently:

a) Swag purchased assets and supposed the liabilities of Perk by paying $1,400,000 in cash and issuing a $12,600,000 note.

b) Swag issued 280,000 common shares in exchange for all of Perk’s outstanding shares. Fair value of Swag shares was $14,000,000.

c) In exchange for all of Perk’s outstanding shares, Swag paid $700,000 cash and issued 189,000 common shares with the market value of $9,450,000.

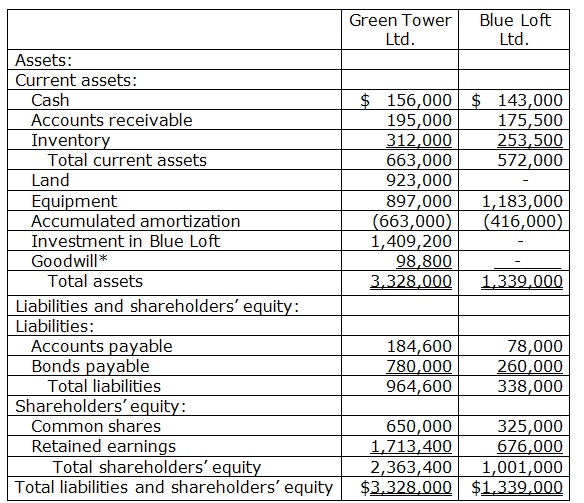

Problem 2

Balance Sheets

December 31, 20X3

Income Statements

Year Ended December 31, 20X3

Green Tower Ltd. Blue Loft Ltd.

Sales revenue $1,560,000 $1,283,100

Cost of goods sold 1,040,000 845,000

______ ______

520,000 438,100

Gain on sale of land ______ 273,000

______ ______

520,000 711,100

Operating expense 305,500 464,100

Net income 214,500 247,000

Income Statements

Year Ended December 31, 20X3

Statements of Retained Earnings

Year Ended December 31, 20X3

Green Tower Ltd. Blue Loft Ltd.

Retained earnings, December 31, 20X2 $1,498,900 $ 429,000

Net income 214,500 247,000

Retained earnings, December 31, 20X3 $1,713,400 $ 676,000

Blue Loft Ltd.

Carrying and Fair Values

January 1, 20X2

Carrying Value Fair Value

Cash $ 104,000 $ 104,000

Accounts receivable 128,700 128,700

Inventory 231,400 253,500

Land 650,000 811,000

Equipment 390,000 151,000

Accumulated amortization (260,000)

Accounts payable 91,000 91,000

Bonds payable 260,000 260,000

Common shares 325,000 -

Retained earnings 568,100 -

• On January 1, 20X2, Green Tower Ltd. obtain all the outstanding common shares of Blue Loft Ltd. for $1,409,200 cash.

• At December 31, 20X2, Green Tower’s inventory incorporated goods which it had purchased from Blue Loft for $58,500. Intercompany profit on these goods was $15,600. All these goods were sold to third parties in 20X3.

• During 20X3, Green Tower purchased goods from Blue Loft for $195,000. Blue Loft earned a gross profit of $65,000 on this sale. At December 31, 20X3, Green Tower still had 40% of these goods in its inventory.

• During 20X3, Green Tower sold goods to Blue Loft for $507,000. Green Tower earned a gross profit of $117,000 on this sale. At December 31, 20X3, Blue Loft still had 20% of these goods in its inventory.

• In December, 20X3, Blue Loft sold a tract of land to Green Tower for $923,000. Blue Loft had purchased the land 8 years ago for $650,000.

• At the time of Green Tower’s acquisition, Blue Loft’s equipment had a remaining estimated useful life of 3 years. Blue Loft uses the straight-line method of amortization, with no residual value.

Required:

Make the consolidated financial statements for 20X3 using the direct method.

Problem 3

Cox Ltd. acquired 70% of the common shares of March Co. at the beginning of 20X7. At the acquisition date, March’s shareholders’ equity consisted of the following:

Common shares $720,000

Retained earnings 360,000

The only acquisition differential pertained to goodwill.

Cox’s “Investment in March” general ledger account is as follows:

1/2/X7 Cost $ 781,200 12/31/X7 Dividends $33,600

12/31/X7 Investment Income 62,160 12/31/X8 Dividends 42,000

12/31/X8 Investment Income 76,440 12/31/X9 Dividends 50,400

12/31/X9 Investment income 94,080

Balance $ 887,880

March generally declares half of its profits as dividends.

Cox uses the entity theory method to consolidate its subsidiary.

Required:

a) Compute the total amount of dividends declared by March for 20X7.

b) Compute March’s profit for 20X8.

c) Compute the non-controlling interest amounts for Cox’s 20X9

i. consolidated income statement, and

ii. consolidated balance sheet.

d) Compute the amount of goodwill that should appear on Cox’s 20X9 consolidated balance sheet.