1. What are the economic functions that financial intermediaries perform that benefit society? In your answer, discuss the relationship of financial intermediaries and financial markets to the savings-investment process within an economy and to each other. As part of your discussion provide an analysis of the differences in preferences among economic agents as an explanation for the wide variety of primary and secondary securities found in financial markets.

Be sure to explain how depository intermediaries, like banks, differ from other financial institutions such as investment banking firms or securities brokerage companies, and how financial intermediaries profit from the transformation of primary securities into secondary claims.

Carefully, DEFINE YOUR TERMS.

2. Banks and other depository institutions make loans, invest in government securities, buy and sell federal funds, and accept deposits with a wide spectrum of maturities and with many payable on demand. Furthermore, depository institutions are the principal repositories of the public's liquid assets and many of these institutions' liabilities are considered a means of payment (money).

(a) Briefly discuss the risks facing these institutions within the context of how these institutions can have such a wide variety of assets and liabilities and still maintain their ability to make illiquid loans, meet deposit withdrawals on demand, and make profits for their shareholders.

Within this context, discuss the effect of different yield curve structures (upward sloping, downward sloping, or flat) on the profitability and riskiness of banks choices of loans, investments, and liabilities (deposits).

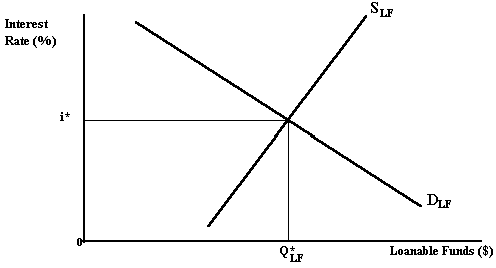

3. Using the graph below of the supply of loanable funds, SLF, and the demand for loanable funds, DLF, discuss the following:

a. What is meant by the equilibrium rate of interest ?

b. Illustrate and discuss how an autonomous increase in the expected rate of inflation will change the equilibrium nominal interest rate. Consider an initial real rate of interest of 3 percent and an expected inflation rate of 4 percent. If the expected rate of inflation rises to 6 percent with the real interest rate constant, what would the resulting nominal interest rate become, using the Fisher relationship?

4. There are a number of theories of the term structure of interest rates including the pure expectations hypothesis, preferred habitat hypothesis, and market segmentation hypothesis.

Discuss the implications of each of these theories in the context of the following problem.

Problem: For a two-year, default-free, pure discount security, compute its yield to maturity and draw the respective yield curves assuming two different expectations of inflation employing the Fisher Effect(see Hints in 3 above): (a) 10 percent one year from now, and (b) 15 percent one year from now. In addition, define and compute the implied forward yield on a one-year security one year from now, assuming the current two-year yield is 10.695 percent. Discuss the assumptions underlying this calculation and how it can be used to evaluate the implied forward yield on a 1-year loan, next year.

Use the following definitions and values:

• r = 0.03 (constant real rate of interest)

p1 = 0.05 (period 1 rate of inflation)

(a) p2e = 0.10 (expected period 2 rate of inflation)

(b) p2e = 0.15 (expected period 2 rate of inflation)

1y1 = current yield on one-year securities

2y1e = Expected period 2 yield on one-year securities

1y2 = current yield on two-year securities

Pure Expectations Hypothesis

(1 + 1ym) = [(1 + 1y1)(1 + 2y1e). . .(1 + my1e)]1/m and jy1e = the forward rate, jf1.

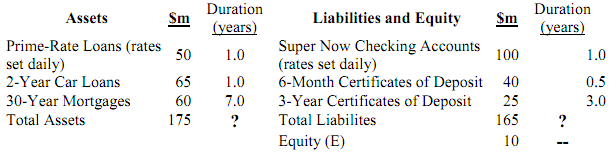

5. Consider the following bank balance sheet (fixed rates and pure discount securities unless indicated otherwise). Interest rates on liabilities are 10 percent and on assets are 12 percent.

• a. What is the duration of assets, DA, liabilites, DL, and Equity, E.

b. The bank will benefit or be hurt if all interest rates rise (assume by the same amount).

c. Compute the repricing gap for the bank using those assets and liabilities repricing or maturing in 2 years or less. From this information, will the bank be hurt or benefit by a 200 basis point rise in interest rates on assets and liabilities?

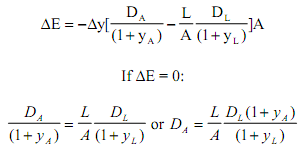

d. If the bank gets an additional $100 in a 6-month certificate of deposit, what investments (using the above portfolio possibilities) should it make to control interest rate risk (Δ y = � 200 basis point change in all interest rates) by changing the duration of its portfolio? State the advantages and disadvantages of using net worth immunization and asset/liability duration as a means of controlling interest rate risk. Define your terms.

ΔE = change in market value of the portfolio,

DA = duration of assets,

DL = duration of liabilities,

DE = duration of the portfolio or equity,

E = market value of equity,

L = market value of liabilities,

A = market value of assets, and

Δy = change in interest rates.