Discuss the below:

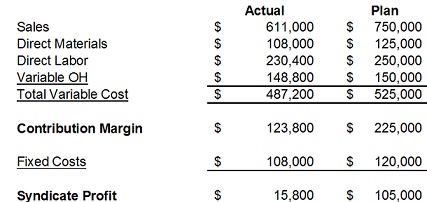

Q: At the end of 2003, Al Second, vice president of Chicago Syndicate, Inc., stared out the window of his posh west side office in dismay. His expectations for a highly profitable year were dashed. The disappointing results appear below:

Q: Mr. Second realized that because sales were down, expenses should also fall, such that profit should be somewhat more than $15,800. His organization which made only one product (the identity of which cannot be disclosed), incorporated the following data into its plans.

STANDARD COST AND CONTRIBUTION MARGIN

Selling price $15.00

Direct Materials (2 quarts @ $1.25/qt) $2.50

Direct Labor (1 hour at $5/hour) 5.00

Variable overhead ($3.00/DLH) 3.00 $10.50

Standard Contribution Margin $ 4.50

The firm planned sales of 50,000 units but sold only 47,000 at an average of $13.00 per unit. 96,000 quarts of direct materials were bought and used. Direct labor hours were 48,000. Production was 47,000 units.

Compute the relevant material, labor and overhead variances that would explain why profit was so much lower than planned, and write a letter to Mr. Second explaining his plight.