Comparing Traditional and Activity-Based Product Margins

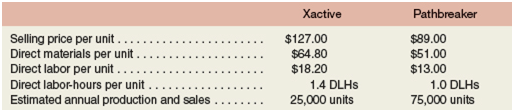

Rocky Mountain Corporation makes two types of hiking boots-Xactive and the Pathbreaker. Data concerning these two product lines appear below:

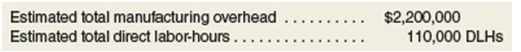

The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below:

Required:

1. Compute the product margins for the Xactive and the Pathbreaker products under the company's traditional costing system.

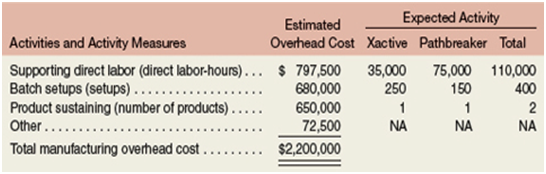

2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs):

Compute the product margins for the Xactive and the Pathbreaker products under the activity-based costing system.

3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Explain why the traditional and activity-based cost assignments differ.