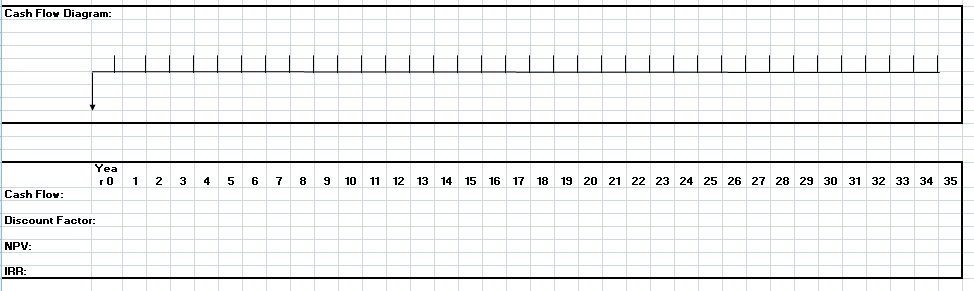

Problem: The Excel spreadsheet template provided below contains detailed directions and figures regarding Blue Mesa's new project. Use the template to create a cash flow diagram of the project's inflows and outflows, as follows:

Input the yearly project inflows

Compute the discount factor for each year

Compute the NPV of the project

Using the cash flows in the template, use the IRR formula to calculate the IRR of the project

Instructions: Blue Mesa Oil needs to launch a new production facility to reach its strategic goals. The new facility will cost $15 million to acquire. The company will use it for 35 years, at which time the company expects to sell the facility for $1.2 million. The product from the new facility is expected to generate year-end net cash inflows of $3.2 million during every year of its 35-year life. Compute the NPV and IRR of the project. For your NPV calculations, assume a cost of capital of 15 percent.