Question 1. Preparation of flexible budgets

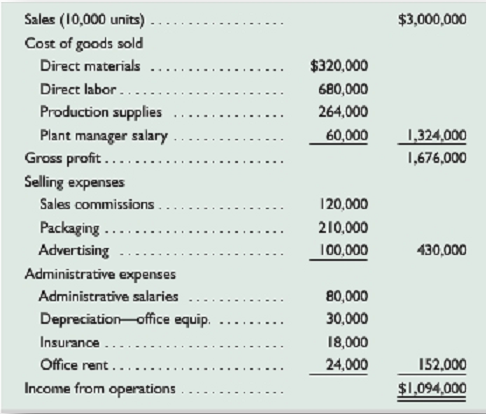

Mesa Company's fixed budget for the first quarter of calendar year 2014 reveals the following. Prepare flexible budgets, following the format of Exhibit 8.3, that show variable costs per unit, fixed costs, and three different flexible budgets for sales volumes of 7,500, 10,000, and 12,500 units.

Question 2. Computation and interpretation of labor variances

After evaluating Zero Company's manufacturing process, management decided to establish standards of 1.5 hours of direct labor per unit of product and $11 per hour for the labor rate. During October, the company used 3,780 hours of direct labor at $45,360 total cost to produce 2,700 unit of product. In November, the company used 4,480 hours of direct labor at a $47,040 total cost to produce 2,800 units of product.

1. Compute the labor rate variance, the labor efficiency variance, and the total direct labor cost variance for October and for November.

2. Interpret the October direct labor variances.

Question 3. Computation and interpretation of materials variances

BTS Company made 6,000 bookshelves using 88,000 board feet of wood costing $607,200. The company's direct materials standards for one bookshelf are 16 board feet of wood at $7 per board foot.

1. Compute the direct material variances incurred in manufacturing these bookshelves.

2. Interpret the direct materials variances

Question 4. Computation of total overhead rate and total overhead variance

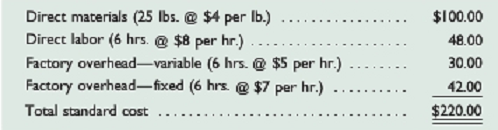

Tuna Company set the following standard unit costs for its single product.

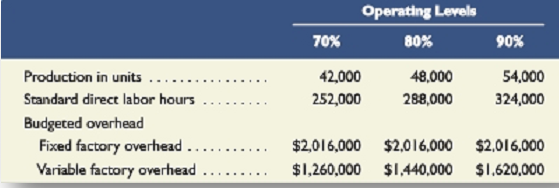

The predetermined overhead rate is based on a planned operating volume of 80% of the productive capacity of 60,000 units per quarter. The following flexible budget information is available.

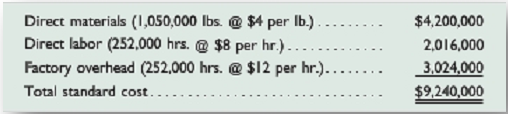

During the current quarter, the company operated at 70% of capacity and produced 42,000 units of product; actual direct labor totaled 250,000 hours. Units produced were assigned the following standard costs:

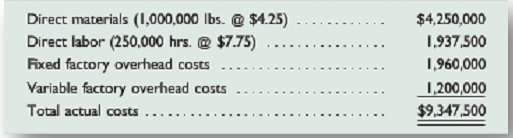

Actual costs incurred during the current quarter follow:

1. Compute the direct materials cost variances, including its price and quantity variances.

2. Compute the direct labor variances, including its rate and efficiency variances.

3. Compute the overhead controllable and volume variances.

4. Compute the variable overhead spending and efficiency variance

5. Compute the fixed overhead spending and volume variance.