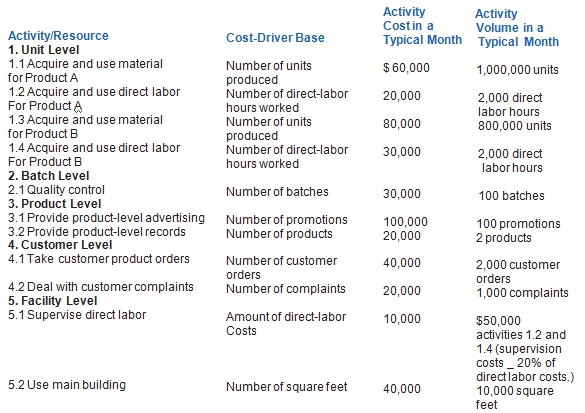

Assignment: An ABC team at Drugs ‘R Us, a pharmaceutical company, identified these data for a typical month:

The company’s management wants you to compute the total cost and unit cost of each product for the month of July, which had the following level of activities:

Product A Product B

1.1 and 1.3 Material 800,000 units 900,000 units

1.2 and 1.4 Direct labor 1,600 hours 2,100 hours

2.1 Quality control-batches 50 batches 40 batches

3.1 Advertising projects-promotions 50 promotions 40 promotions

3.2 Products recorded 1 product 1 product

4.1 Customer orders 800 customer orders 900 customer orders

4.2 Customer complaints 600 complaints 300 complaints

5.1 Direct-labor supervision $16,000 $31,500

5.2 Main building use 6,000 sq. ft. 3,000 sq. ft.

Required

a. Compute the cost-driver rate for each cost-driver base.

b. Use ABC to compute the cost of each of the two products given the activity level for the month of July. Compute both the total cost and unit cost for each product for the month of July.

c. Assume that the company’s traditional costing system had assigned overhead costs at a rate of $.10 per unit of output plus $20.00 per direct-labor hour. Overhead costs are the sum of the batch-level, product-level, customer-level, and facility-level costs. Using this traditional costing approach, compute the cost of each product (including material and direct-labor costs) given the activity level for the month of July. Compute both the total cost and unit cost for each product for the month of July.

d. Do the unit costs of the two products computed under ABC and traditional costing systems differ significantly? If so, what causes the differences?