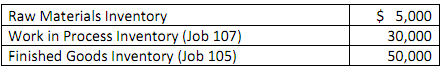

Kramer Manufacturing makes special order products. At March 1, 2013, it had the following inventory balances:

March 2013 transactions:

A. Raw materials purchased on account, $60,000

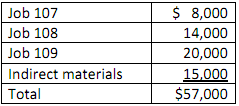

B. Materials requisitioned from the supply room:

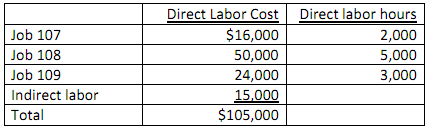

C. Factory labor costs paid in cash were $105,000 for the month of March.

D. Labor costs were assigned as follows:

E. Additional overhead costs during the month:

- Overhead incurred on account, $3,000

- Overhead paid in cash, $4,000

- depreciation on factory assets, $1,000

F. Overhead is applied on the basis of direct labor hours. Annual overhead costs for 2013 are estimated at $320,000 and total direct labor hours are estimated to be 80,000 for 2013. Hint: you need to compute the predetermined overhead rate.

G. During the period, Jobs 107 and Job 109 were completed.

H. Job 105 was sold for $80,000 on account and Job 109 was sold on account for $100,000.

Required:

1. PLEASE NOTE: I suggest printing this problem and the answer sheet and completing it by hand before doing it on the computer. It is much easier to see everything if it is sitting in front of you. This will also allow you to work on this problem without having to sit in front of a computer monitor for a long time.

2. Enter the beginning balances in the appropriate ledger accounts and job cost sheets. Remember, job cost sheets constitute the subsidiary ledger for the Goods (Work) in Process Account.

3. Prepare journal entries to record the March 2013 transactions. In the date column, type the transaction letter (A, B, C, etc). There will be something to record for each transaction letter so makes sure you record everything you should. Post your entries to the ledger accounts provided and to the job cost sheets provided. You should probably post after EACH transaction to make sure your account balances are up to date for the next transaction you record. The company does not close any over or under-applied overhead until the end of the fiscal year --- that would be in December 2013- so don't do anything with any under or over applied inventory.

4. Prepare a manufacturing statement for March of 2013. You do not need to include the detail for changes in the raw materials inventory --- you know the amount of direct materials used so you do not have to compute it. We are not going to do anything with under or over applied inventory until December of 2013 so don't do anything about it on this manufacturing statement.

5. Prepare an income statement for the month ending March 31, 2013. Operating expenses are $44,000 and income tax expense is 20% of income before tax.

6. Compute the balances of the inventory accounts and show how they are disclosed in the financial statements.

7. Compute the ending balance of factory overhead. Indicate if this amount is over-applied or under-applied. You don't have to prepare the entry to close the under or overapplied overhead.